Ever since the world came into being, especially post-industrialization, we can see that the amount of businesses that have emerged is countless. The amount is so countless, that a cluster of similar businesses eventually gets grouped together to make a proper market.

It is safe to assume that the amount of markets is far too great as well, so it will be handy to have a better understanding of them, which is why we have an Insurance market SWOT analysis penned down here.

The insurance market essentially deals with securing people’s lives, business ventures, assets, properties, health amongst other things with financial backing in case of a sudden unwanted or unforeseen event such as death, loss, accidents, and even fraud.

It has been in the world for many years now because people are always in search of protection against danger and money is perhaps one of the most essential commodities to have for anyone’s survival.

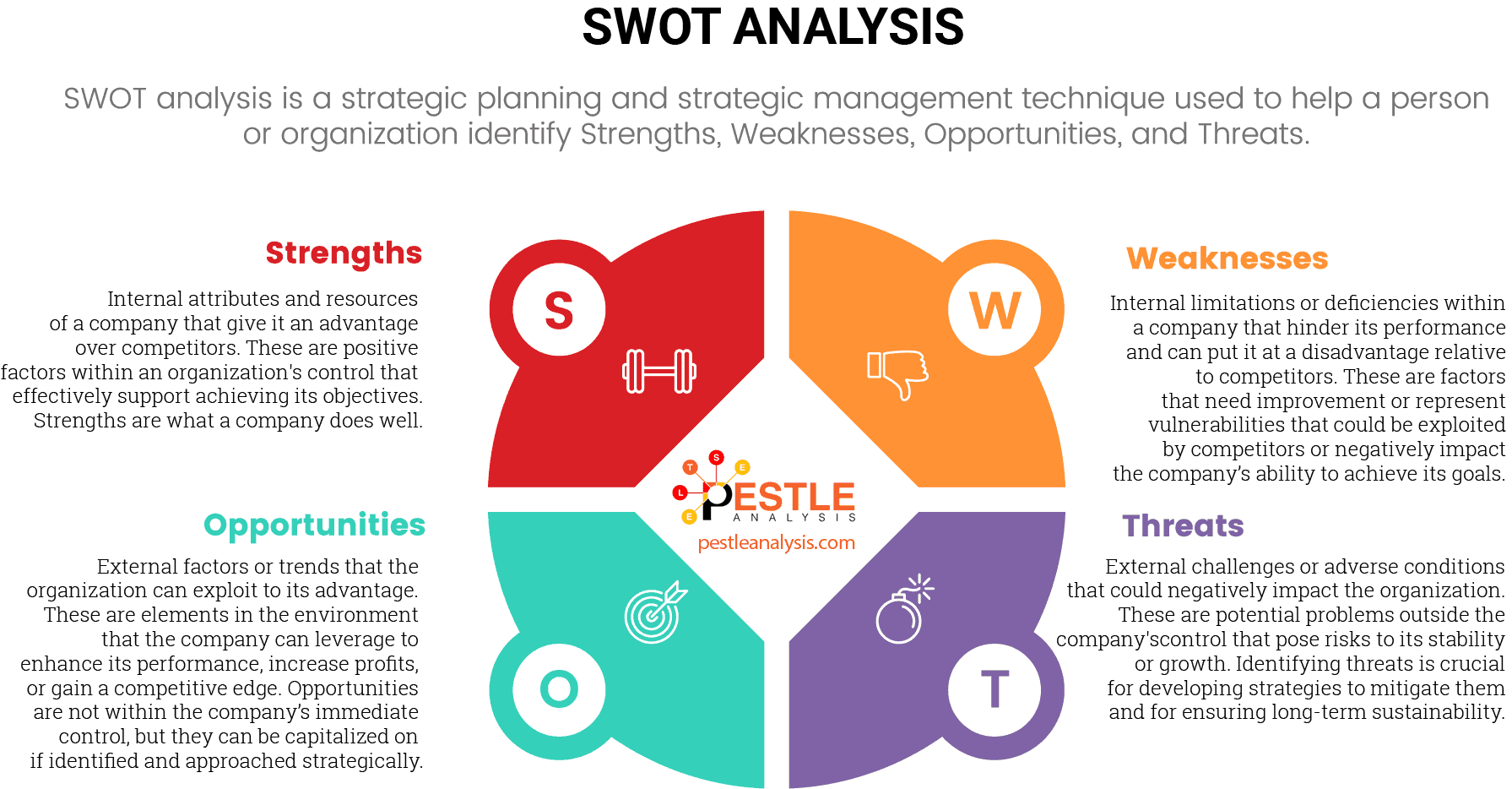

Before we jump into the details of the SWOT, it is important that you understand which of these factors are internal and which are external; strengths and weaknesses are factors that can easily be controlled or influenced by the industry.

Any factors or realities which benefit the insurance industry will be called strengths in this industry because they eventually become incentives for being in it. The factors or realities which become hindrances to success in this industry would be called weaknesses.

The insurance industry in a way gets to affect the amount and types of strengths and weaknesses that they have hence these are internal factors.

Threats and opportunities on the other hand are factors that arise on their own spontaneously and the industry cannot control them in any way; these are external factors.

To briefly put it, All the factors or rather potential factors which can be beneficial for the industry’s future success are its opportunities.

And last but certainly not least, all the factors which are dangerous for an industry’s wellbeing can be called threats to that industry. Threats are what need to be kept strictly in check.

Let’s understand this with the help of an example if consumers in a particular country where insurance isn’t very big come to realize the importance of having their assets insured it will be a big opportunity for the industry to expand its customer base.

However, if the consumers are not as educated on the importance of insurance as they ought to be, their ignorance is a threat to the industry.

Now that all of this is clear, it is okay to move on to our analysis in order to fully appreciate the scope of the insurance industry.

Insurance Market’s Strengths

It is quite horrific to think that we all are just one incident away from losing our lives, our loved ones, or our property to sudden calamities.

Whereas, nothing can replace a human life and losing huge assets is never fun, what can be done is to have some financial security during such times which is where insurance comes into play.

Financial Protection

As stated above, human life and its occurrences have no prediction whatsoever at times. The biggest reason that people show up at insurance companies is to have a financial safeguard for themselves and their families in case something horrible takes place.

People die and leave dependent family members behind. Businesses get bankrupt every day. Cars get stolen every second. Insurance is a sure-shot way to take care of one of life’s biggest stressors; money in times of need.

So as long as people have the need for protection which let’s face it will always exist, insurance is not fizzling out anytime soon.

Takes Care of Business Property

If a business is insured, then no matter how small a bad occurrence is, the insurance plan will most likely cover all sorts of damages.

E.g. If a fire erupts and one room of the building gets damaged, everything in the room from the equipment, furniture, electronics, etc. will be covered under the insurance plan.

Fosters International Trade

The global economy would crumble really badly if all sorts of trading ceased to take place. Would you be able to live without your favorite packet of chips from India if the US just decided not to do business with them ever again? The effect of trade going down would be a little direr though.

Insurance is actually foddered for international trading practices. In the past, people used to be skeptical about trading because of the huge potential losses that take place in transit, but if everything is insured then the insurance company would take responsibility for them.

Newer Products

Thanks to the increasingly competitive world we are living in, new and innovative products always enter the market that need to be insured so insurance is always in need. Before we know it, Elon Musk’s humanoids will need to be insured too.

Insurance eventually becomes the difference between a person going into debt if an unfortunate event takes place or a person not breaking their bank.

Insurance Market’s Weaknesses?

Like any other entity of this world, the insurance industry is also prone to some weaknesses which become a factor in reducing the prospects.

Fraud Cases

No matter how foolproof the process might be in the big players of the industry, unfortunately, insurance is very susceptible to fraudulent practices. Many agencies and companies which are not qualified attempt to dabble in insurance thereby causing many troubles for a lot of people.

This creates an atmosphere of distrust and hence stigma against the industry; having less money in times of need is far better than having none at all because some fraud stole it.

It is Expensive

Although this varies from one insurance type to another, for many businesses insurance policies can be very expensive! Moreover, as businesses grow, their insurance needs to be updated too in order to account for the totality of it. This stops many businesses from investing too much in insurance.

They Can be Threatening

As ironic as it sounds, insurance policies can be very dangerous as well; think of what they show in the movies, so many people get murdered for insurance money. Movies, though exaggerated, are often based on real events. Many business owners commit fraud to benefit off of the insurance cash.

While on one hand insurance protects the financial needs of so many, on the other hand, it becomes a provocative tool for many crimes to take place so many people choose to steer clear from it.

Not Fully Inclusive

At the end of the day, insurance is a form of business and every business has one universal principle; profits. Many types of insurance such as life don’t exactly cater to everyone, especially the most vulnerable; very old or very sick people are not catered by insurance because they are expensive.

Insurance Market's Opportunities

No matter how vastly spread a market is, there is always room for growth. Thing is, that as big as the market becomes, the more difficult it gets to identify some promising opportunities. That does not mean that no hope exists, however.

Emerging Economies

In first-world countries where the economies are much more stable and strong, insurance has a well-established place in the market with many customers to satisfy. However, in many emerging countries, insurance has a very bright future.

As the economy begins to expand in a nation, the need for having assets insured increases. Insurance still has a huge possibility for growth in such countries.

A growing economy suggests growth in education and exposure as well thereby becoming a catalyst for increasing the knowledge of insurance amongst the people.

Many forms of insurance such as health insurance always have an opportunity for growth because the population is increasing at an exponential rate.

Target Individuals

Traditionally the bread earner of the family gets to make decisions about whether or not to get insured. With the pandemic not ending anytime soon, many people are confined to their homes and work using digital spaces.

It has become very easy to target individual people with microinsurance products, provided some good ones are developed.

Digital Insurance

Whereas many businesses and people understand the sensitivity of data encryption and protection, the older generations are not exactly tech-savvy.

They can become an excellent market for various forms of digital data protection insurance especially now when the majority of the world is working online.

Insurance Market's Threats

Even insurance, the business that makes threats go away, is not safe from threats. Poetically ironic, it is. Anything which deals directly with money is bound to have threats associated with it. Let’s take a closer look at how insurance is threatened in today’s world.

Dynamic Environment

With technology improving every second and the world growing extremely fast in its advancement, the environment has become largely dynamic which means that as businesses, lifestyles, and people adapt and evolve, insurance needs to up the ante every instant.

It becomes very difficult to maintain a stride with the times for insurance.

● Natural Catastrophes

Were you prepared for a global pandemic? Of course not, no one was. Natural disasters and calamities can never be foretold hence the damage and doom they bring can often be much greater than the capacity of an insurance policy.

Extreme Competition

Insurance is one of the most competitive fields out there. There are so many people offering insurance now that it has become very hard to stand out with an edge. With so many alternatives around, there is no guarantee of holding customers for long.

Market/Brand Decline

Many markets and even brands that exist in those markets have become close to obsolete in today’s world. Insurance companies are always at risk of being associated with entities that are no longer salvageable.

Final Thoughts on the Insurance Market SWOT Analysis

If you have stuck with this article for this long, can we make the assumption on your behalf that you now see the insurance market much more clearly than you did before? Hopefully, you are nodding your head up and down.

We have seen in this SWOT analysis that insurance is still thriving as a market, perhaps even more so than it was in the past.

As far as the internal factors are concerned, the strengths outweigh the weaknesses otherwise it would not be as popular a business as it is. it is an excellent mechanism of securing financial backing, especially in this capitalistic society.

It does have several weaknesses which can be mitigated if not eliminated completely, especially the fraud cases which do a lot of harm to sincere practitioners. The external factors are very interesting to note as well because where there exist many threats for this market, there also exist many opportunities to counter those threats.

Overall, the market has nothing to be too wary of because insurance is not becoming extinct anytime soon.

A SWOT analysis is one of the easiest to understand, use and implement frameworks available for improving your organization. It can be applied to industries at large as well to understand them in more depth.

It highlights the strengths and weaknesses which occur on the inside and the threats and opportunities which linger outside. If you know these four components of the SWOT, you very easily can be on the road to improvement and growth. Knowing how to conduct a SWOT analysis is a very useful skill to have for working professionals as well as students to have.

If you wish to work on a SWOT of your own to increase your knowledge, we recommend the use of a good template. Moreover, you can understand how the analysis works by taking a look at a few extra examples. The easiest way to understand and explain a SWOT analysis visually is to draft it in a tabular form. It is more concise, clean, and comprehendible like this.