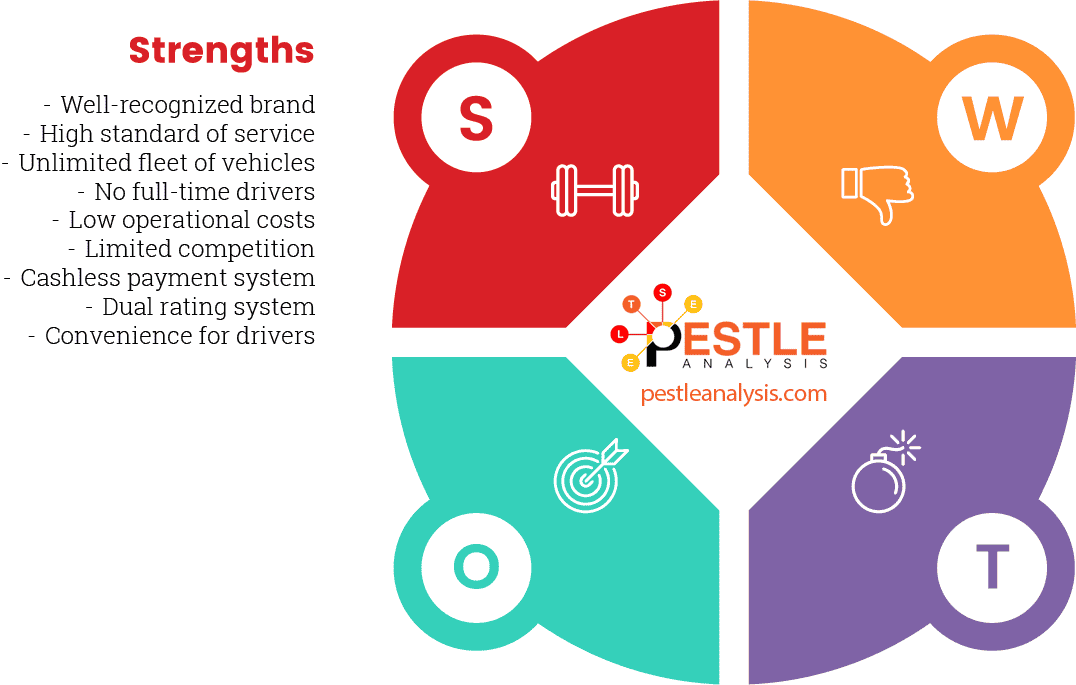

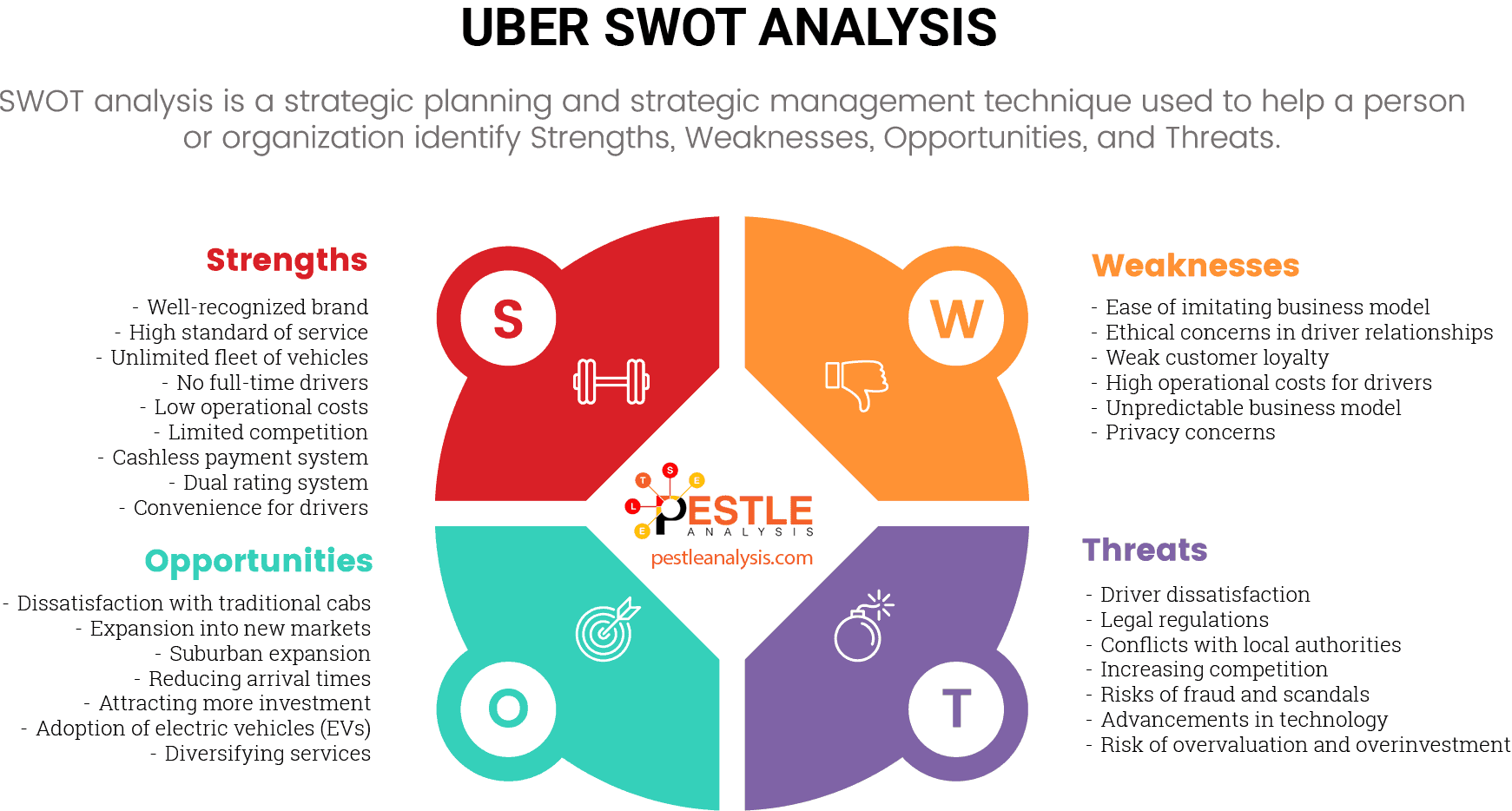

Our Uber SWOT Analysis examines 11 strengths, 6 weaknesses, 7 opportunities, and 7 threats, providing a detailed overview of the factors the company must monitor closely.

Below, I explore a comprehensive SWOT analysis of Uber, the trailblazing company that revolutionized the transportation industry. Since its inception in 2009, Uber has expanded beyond its initial scope, becoming synonymous with on-demand ride services.

This UBER SWOT analysis delves into Uber’s internal strengths and weaknesses and examines its external opportunities and threats.

We will also trace Uber's journey to becoming a dominant player in the transportation sector, discussing pivotal moments like its rapid rise to popularity around 2011-2012. Finally, we will conclude with strategic recommendations tailored to help Uber capitalize on its advantages and mitigate its risks.

Uber Company Overview

When did UBER become popular?

First things first: How did UBER get its name?

Uber got its name from the slang word "uber," which means "topmost" or "super." The founders, Garrett Camp and Travis Kalanick, chose the name "UberCab" initially to reflect the idea of providing a superior or excellent cab service that was a cut above traditional taxi services.

How did UBER start? Uber is a high-tech company that was created in 2009 as "UberCab" in San Francisco. Eventually, they had to drop the "Cab", partly due to legal issues concerning the use of the word "cab" without holding a taxi license. This change also helped in branding the service more broadly beyond just a taxi alternative as the company expanded into various other transportation and delivery services.

Uber initially launched its mobile app in 2010. UBER's ride-sharing app brilliantly connects the transportation industry with technology. UBER model allows users to hail a ride with just a few taps on their smartphones. The innovative concept quickly caught on due to its convenience, transparency in pricing, and the ability to track the vehicle's location in real-time.

By 2011, Uber had begun expanding into other major cities in the United States and internationally, leveraging aggressive marketing and expansion strategies. This rapid expansion and its model of disrupting traditional taxi services helped it become a prominent player in the emerging gig economy and a household name by the early 2010s.

In 2014, it was stated as the highest-valued venture-supported company. Uber offered its service in over 200 cities in 53 countries by 2014.

As of April 2024, Uber's market cap is $144.04 Billion, which is more than the entire U.S. taxi and limousine industry.

Why do people love UBER's model?

Uber continues to be popular in 2024 for its convenience, ease of use, and cost-effectiveness. However, the company also faces mixed reactions. Local governments, traditional taxi services, and even some Uber drivers express concerns over the company’s practices.

Given these diverse perspectives, it’s crucial for Uber to consider strategic adjustments.

The demanding and gruelly competitive transportation industry and ongoing debates about Uber's dominance underscore the need for a comprehensive SWOT analysis. This analysis will help pinpoint the opportunities and threats Uber may encounter, while also clarifying its strengths and weaknesses, providing a clear path for future growth and adaptation.

Strengths and weaknesses are internal factors over which Uber has direct control. These aspects of the business can be actively managed and optimized based on company strategies and decisions.

On the other hand, opportunities and threats are external factors in a SWOT analysis which lie outside of Uber’s immediate control. Despite this, it is crucial for Uber to proactively identify and leverage these opportunities while implementing strategies to mitigate the threats.

Below, I have outlined the SWOT analysis of Uber, expanding on its four parts.

UBER Strengths

In any SWOT analysis, the framework begins by identifying strengths and highlighting the internal capabilities and resources that give the company a competitive advantage.

Well-recognized brand

Uber’s brand recognition is a significant strength. Its pioneering role in the ride-sharing industry helped establish its name synonymously with on-demand transportation services. This strong brand identity aids in market dominance and consumer trust.

High standard of service

Uber’s differentiated offerings, like Uber Black, provide high service standards with luxury vehicles and professional drivers. This segmentation helps cater to diverse customer needs, enhancing user satisfaction and retention.

Unlimited fleet of vehicles

By utilizing a network model without owning vehicles, Uber can scale its operations without the capital expenditures associated with a traditional taxi fleet. This flexibility helps meet varying demand efficiently.

No full-time drivers

Uber’s model of partnering with drivers as independent contractors reduces its labor costs and responsibilities. However, this can be a double-edged sword, as it also leads to ongoing legal challenges and driver dissatisfaction.

Low operational costs

The tech-driven approach eliminates the need for dispatch centers, lowering operational costs significantly compared to traditional taxi services. This tech focus also drives innovation.

Limited competition

While Uber faces significant competition globally from companies like Lyft, Didi Chuxing, and Ola, its early mover advantage and scale allow it to maintain a strong market position. However, the competitive landscape is intensifying, and this might change.

Cashless payment system

This feature not only enhances convenience and safety by minimizing cash handling but also allows Uber to gather valuable data on customer preferences and behavior, which can be used to optimize their service.

Dual rating system

The mutual rating system for drivers and passengers fosters a safer and more accountable environment, enhancing trust and encouraging better service.

Convenience for drivers

The flexibility in work hours makes driving for Uber attractive to many looking for part-time or flexible work. This also helps Uber maintain a large and scalable workforce.

Lower prices

Competitive pricing makes Uber an attractive option compared to traditional taxis, which often results in higher consumer demand.

High valuation

Uber’s high market valuation reflects investor confidence and provides capital for expansion and technology investment. However, it’s crucial to manage these investments wisely to ensure long-term profitability.

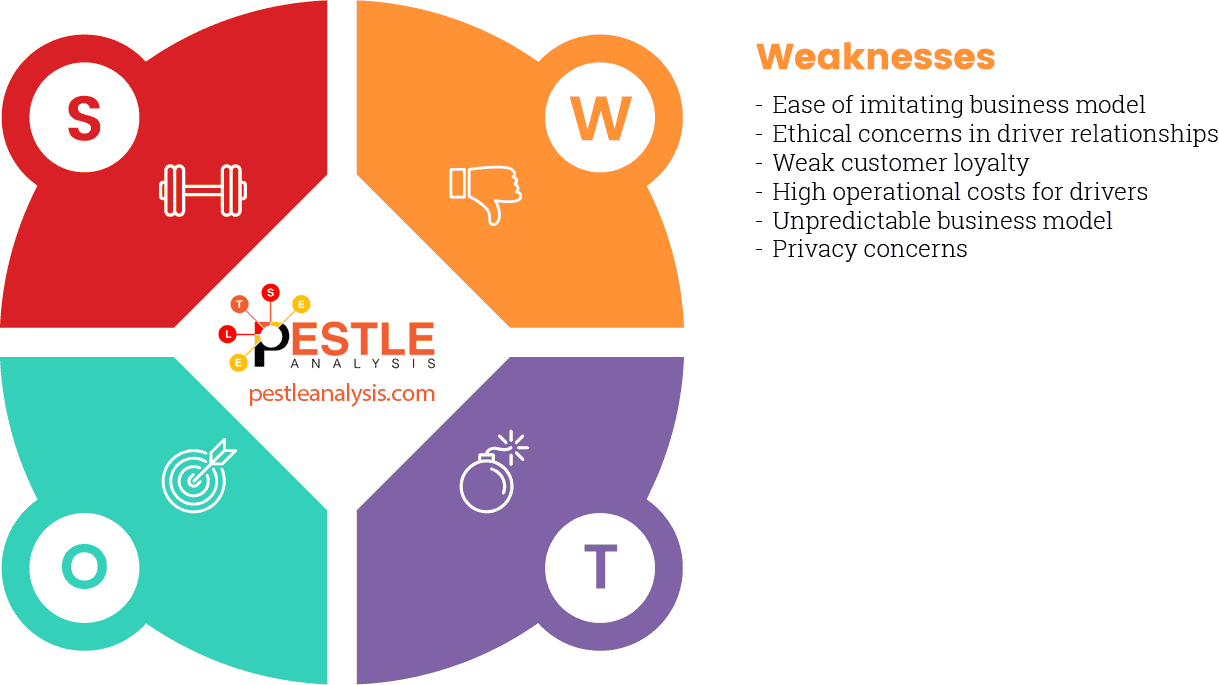

UBER Weaknesses

Following the strengths, a SWOT analysis next examines weaknesses, which are internal factors that may hinder a company's ability to achieve its objectives.

Ease of imitating business model

Indeed, the basic premise of Uber's business model—a platform that connects drivers with riders through an app—is straightforward to replicate, leading to intense competition. Nothing will prevent competition from presenting the same product. This is evident with numerous similar services around the world. To counter this, Uber must continuously innovate and differentiate its offerings to maintain a competitive edge.

Ethical concerns in driver relationships

Uber's treatment of drivers as independent contractors rather than employees has been a subject of ongoing ethical and legal debate. This classification limits drivers' benefits and protections, which can lead to dissatisfaction and low loyalty. Improving driver conditions or rethinking the employment model could be beneficial in building a more committed workforce.

Weak customer loyalty

The ride-sharing market generally suffers from low customer loyalty since switching costs between services like Uber and Lyft are minimal. Enhancing customer loyalty could involve offering more personalized services, loyalty programs, or better customer service.

High operational costs for drivers

While Uber’s asset-light model keeps its corporate costs low, drivers bear the brunt of operational expenses like vehicle maintenance, fuel, and insurance. This can lead to dissatisfaction, especially if earnings do not adequately cover these costs. Uber could consider strategies to help reduce these burdens or increase drivers' take-home pay.

Unpredictable business model

The ride-sharing industry faces various unpredictable elements, such as regulatory changes, fluctuating demand, and economic downturns. Diversification and strategic planning are crucial for mitigating these risks.

Privacy concerns

The data Uber collects on passengers and their travel patterns can lead to privacy issues. To address these, Uber must ensure strict data protection practices and transparency about how customer data is used and protected.

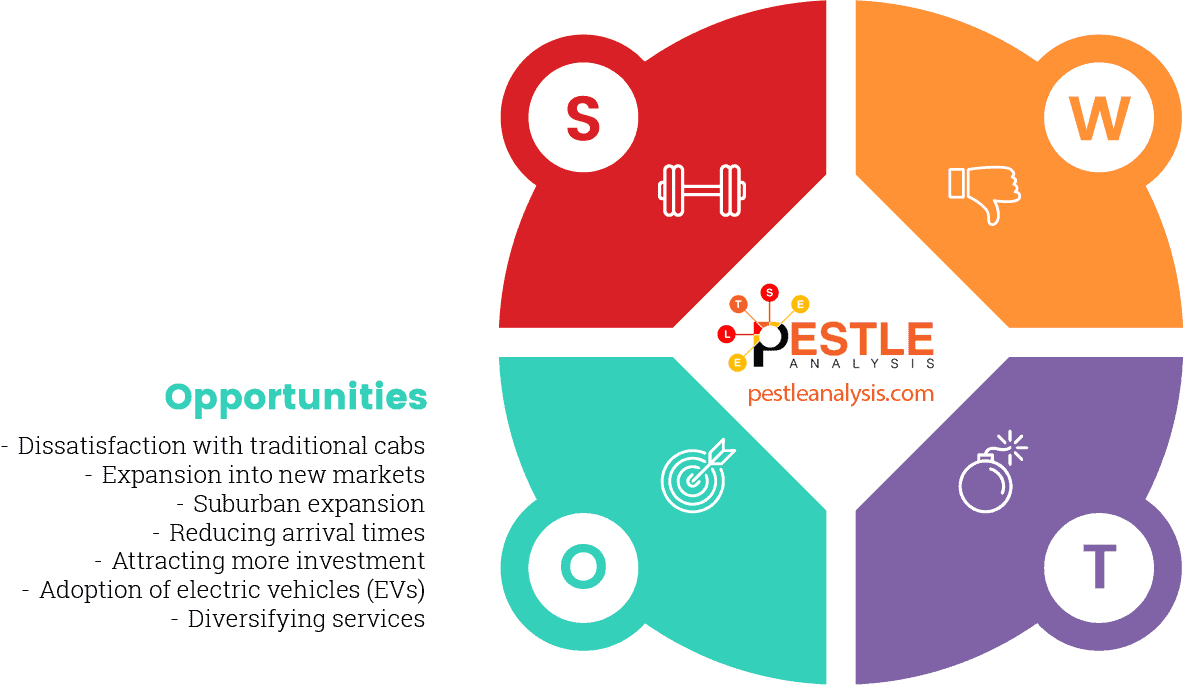

UBER Opportunities

After addressing internal factors, a SWOT analysis explores opportunities, which are external favorable conditions that could be exploited to benefit the company.

Dissatisfaction with traditional cabs

This is a significant opportunity for Uber to capture market share from traditional taxi services. By emphasizing its strengths—like shorter wait times, competitive pricing, and superior customer experience—Uber can attract customers who are unhappy with traditional services.

Expansion into new markets

Entering new geographical areas like India, where there is a high demand for reliable and affordable transportation, represents a huge growth opportunity. Success in these markets will depend on Uber’s ability to navigate local regulations and adapt its business model to local needs and economic conditions.

Suburban expansion

Many suburban areas lack sufficient public transportation and taxi services, providing Uber with the opportunity to fill this gap. Offering services in these areas could tap into a new customer base seeking convenient travel options.

Reducing arrival times

Increasing the number of active drivers can indeed decrease the estimated time of arrival for customers, potentially improving customer satisfaction and increasing usage rates. This could also lead to higher earnings for drivers and increased revenue for Uber.

Attracting more investment

As Uber increases its valuation, it can attract additional investment. This capital can be used to fund expansions, technology upgrades, and new service offerings, further solidifying its market position.

Adoption of electric vehicles (EVs)

Utilizing cheaper electric cars can lower operational costs and increase the profit margins for drivers. It also aligns with increasing environmental concerns among consumers and can improve Uber’s public image as a sustainable company.

Diversifying services

Offering specialized transport services—such as rides for seniors to medical appointments, children to school, or pets to veterinary clinics—can open new revenue streams and market segments for Uber. These services would address specific customer needs and could lead to partnerships with healthcare providers, schools, and other institutions.

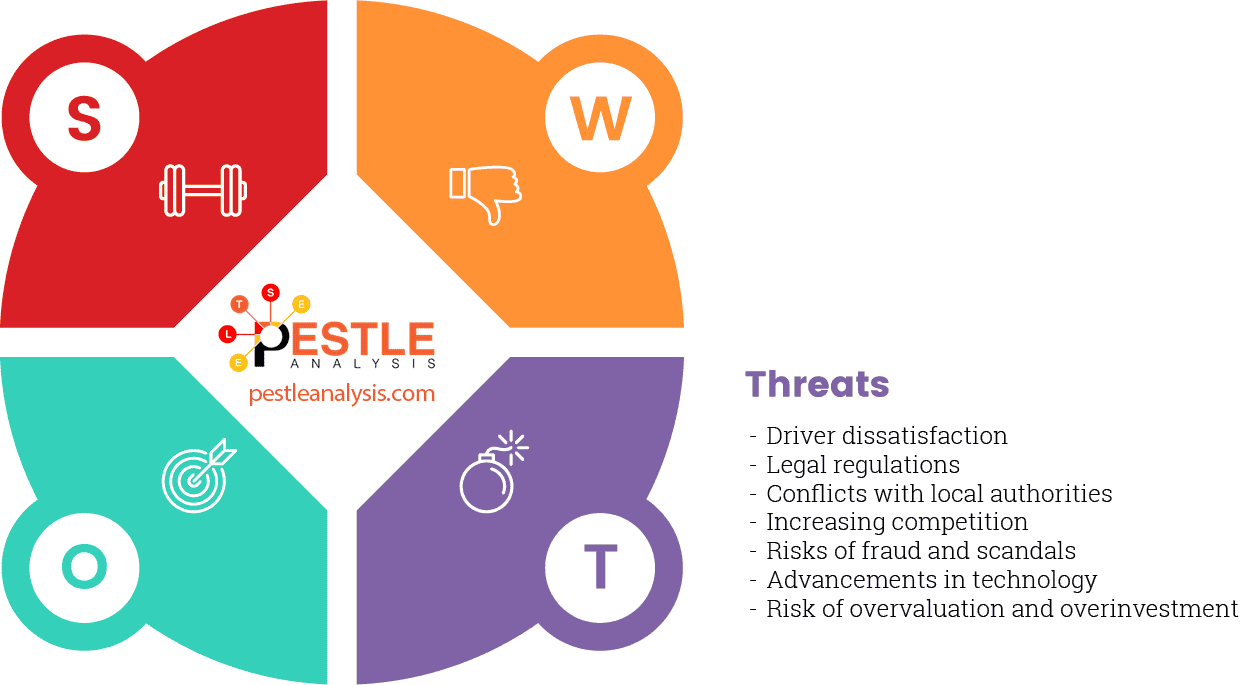

UBER Threats

In the final step, SWOT identifies threats, external challenges, or problems that could negatively impact the company's performance.

Driver dissatisfaction

Low-profit margins for drivers can indeed lead to discontent and negative publicity. This could deter new drivers from joining and even prompt current drivers to leave the platform, affecting service availability and customer satisfaction.

Legal regulations

New legal challenges, such as those seen in Germany and other countries, pose significant threats to Uber’s operations. These regulations can restrict or even ban Uber’s services in certain areas, leading to loss of markets and affecting overall revenue.

Conflicts with local authorities

Issues with local authorities can result in fines and negative publicity, damaging Uber’s reputation and potentially leading to stricter regulations or operational limitations in those regions.

Increasing competition

As more companies enter the ride-sharing market, price wars can ensue. Lower prices may initially attract customers but could also reduce earnings for drivers, making it less attractive for them to work with Uber. This could impact Uber’s ability to expand into new markets effectively.

Risks of fraud and scandals

As Uber expands, managing the quality and integrity of its service becomes more challenging. Incidents of fraud and scandals can damage the brand and erode trust among users, making it difficult to maintain a positive public image.

Advancements in technology (e.g., self-driving cars)

Technological advancements such as autonomous vehicles represent a significant threat to Uber’s traditional business model. Companies like Google are investing in self-driving technology, which could disrupt the entire ride-sharing industry by eliminating the need for drivers.

Risk of overvaluation and overinvestment

High valuations can lead to overconfidence and excessive investment in markets that may not have sufficient demand or are not suitable for Uber’s business model. This could result in financial losses and inefficient allocation of resources.

There is no doubt that customers love Uber. They enjoy the service's benefits. Apart from being convenient, they like how Uber helps save time and money. But governments and drivers often don't share the same feelings with Uber. To maintain its customer-centric approach, the company charges a very low price. This is why the drivers do not have a high-profit margin.

Uber does not have to follow the regulations that traditional drivers must abide by. It has been fined for skirting regulations many times. Germany, France, India, Thailand, Netherlands and United Kingdom are some of the countries that fined Uber. Negative press is something UBER must work on overcoming.

Recommendations based on the UBER SWOT Analysis

Based on our Uber SWOT analysis, here are several strategic recommendations that can help the company enhance its strengths, address its weaknesses, capitalize on opportunities, and mitigate threats:

Enhance Driver Satisfaction and Loyalty

- Implement fair compensation policies: Increase driver earnings by reducing commission rates or offering bonuses for high performance and customer ratings.

- Provide benefits and support: Even as independent contractors, drivers could benefit from access to affordable healthcare, insurance discounts, or vehicle maintenance programs.

Leverage Technology to Maintain Competitive Edge

- Invest in AI and data analytics: Enhance route optimization, demand forecasting, and personalized customer experiences to improve service efficiency and attractiveness.

- Explore autonomous vehicle technology: While this is a long-term strategy, partnering with tech companies could position Uber at the forefront of the autonomous driving revolution.

Expand Market Reach

- Target underserved areas: Focus on suburban and rural markets where public transportation is limited, utilizing Uber’s flexible model to meet demand.

- Diversify service offerings: Consider niche markets such as services for elderly transportation, children’s rides to school, and more specialized delivery services like grocery or pharmacy item deliveries.

Improve Customer Loyalty

- Introduce loyalty programs: Offer rewards, discounts, and exclusive benefits for frequent riders to enhance customer retention.

- Enhance customer service: Invest in customer support to ensure quick and effective resolution of issues, boosting overall customer satisfaction.