Do you have any idea which country is the richest in the world? If you can't guess it, don't worry, I'll tell you. The US is considered the richest country in the world since it has the highest GDP worth $20.89 trillion.

What if I ask you to guess which country has the highest number of banks? This would be easy to guess since any country that is the richest would have the highest number of banks. So again, the US has the highest number of banks.

In 2019 the US was recorded to have 4,488 banks, far more than any country in the world. The US is considered the hub of banking since banking has been practiced there for centuries.

Imagine the competition there would be among banks in such a saturated market. However, JP Morgan is a bank that competed with all the other banks and managed to become the largest bank in the US.

Looking at the size of JP Morgan and its operations, today we have decided to conduct a JP Morgan SWOT Analysis.

However, before proceeding further, let's look at the history and current operations of this bank to better understand what we are dealing with.

JP Morgan was an investment bank whose roots can be traced back to 1868 when JP Morgan partnered with Drexel to establish a firm later named J.P. Morgan & Co. This firm served as an investment bank that would invest in railroads initially.

Later it broadened its canvas and started investing in other areas as well. For example, JP Morgan & Co financed many businesses such as General Electric and US Steel. Meanwhile, Chase bank was founded by John Thompson in 1877. This bank was a commercial bank that kept growing over the years across the US.

Years passed, and JP Morgan & Co and Chase Bank expanded their operations by acquiring several banks and companies. In 1955, one of the most renowned banks in the US, The Bank of Manhattan, merged with Chase to form The Chase Manhattan Bank.

Fast forward to 2000, Chase Manhattan acquired JP Morgan for $32 billion. The outcome of this acquisition was in the form of J.P. Morgan Chase & Co. JP Morgan Chase further expanded its operations by acquiring and merging with different banks.

JP Morgan Chase came into being by combining JP Morgan, an investment bank, and Chase, a famous wholesale bank. Currently, JP Morgan Chase serves as both an investment and commercial bank.

JP Morgan Chase is the largest bank in the world by market cap. The total assets that the bank possesses are worth $3.9 trillion. JP Morgan Chase has grown over the years. It is now considered among the Big four banks of the US, along with Wells Fargo, Bank of America, and Citigroup.

The success of JP Morgan can be determined by the revenue it generates. In 2021, the bank managed to generate revenue of $127.2 billion. To earn this revenue, JP Morgan has hired 271,025 employees.

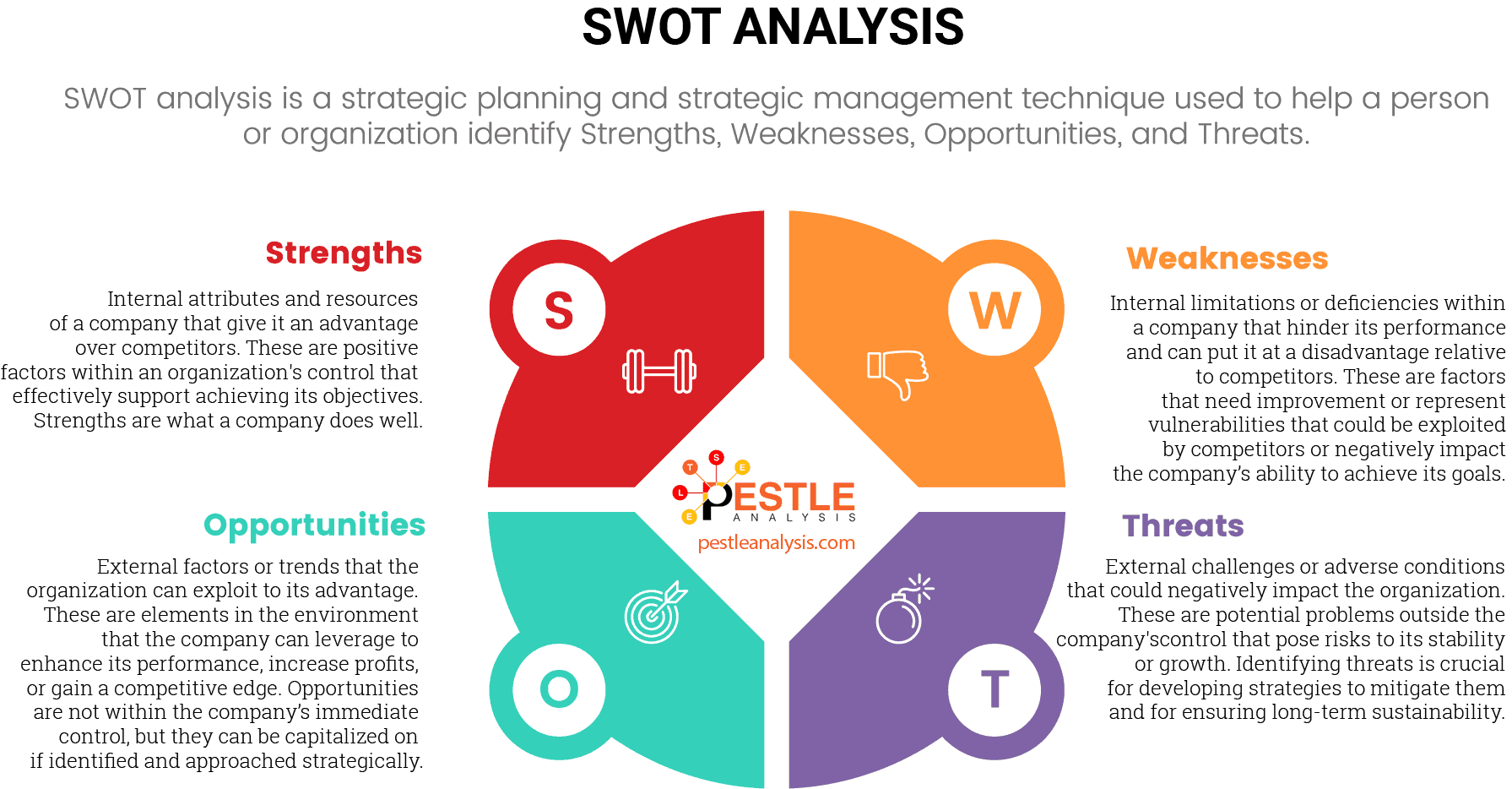

Now that we have discussed the history of JP Morgan in detail and shed light on the current operations of JP Morgan let's carry out JP Morgan's SWOT analysis. But first, you guys need to know what SWOT analysis is.

SWOT analysis is a widely used business technique highlighting the strengths, weaknesses, opportunities, and threats organizations face. A SWOT template depicts the external and internal factors that impact an organization's operations.

Now that we have also discussed the significance of a SWOT analysis, let's proceed further and carry out JP Morgan's SWOT analysis.

JP Morgan Strengths

Strengths are the factors that consolidate an organization's position in the market. An organization's strengths give it an edge to compete with other organizations in the market. Therefore, organizations that have more strengths tend to be in a better position.

In this section, we will look at some of JP Morgan's strengths.

Renowned Brand

Recognition really matters when it comes to doing business. If a brand is well known, it will automatically attract more customers. So brands try hard to make a name for themselves so they can be recognized by the people. However, that's not the case with JP Morgan.

JP Morgan is already a very renowned brand. Since the bank has a centuries-old history, people do know its operations and history of this bank. JP Morgan was ranked 24th on the Fortune 500 list. Such recognition is a strength for JP Morgan because it helps increase the bank's customer base.

Global Presence

Businesses try very hard to increase their presence and expand internationally. Global presence holds great importance for businesses since expanding operations abroad helps increase the customer base, resulting in significant profits.

JP Morgan is a business that is present all across the globe. JP Morgan currently operates in more than 60 countries. This is a strength for the company since its global presence helps JP Morgan increase its customer base and generate higher revenue.

Strong Financial Position

Any business needs to be financially strong to compete so that it can compete in the market in the long term. Therefore, a strong financial position helps the business to operate smoothly. Besides that, it attracts other companies to do business with a financially strong company.

JP Morgan is considered a financially strong bank. JP Morgan is ranked 5th largest bank worldwide in terms of assets. In 2021, the bank had assets worth $3.7 billion. Moreover, JP Morgan is also the largest bank across the globe by market cap.

Innovation and Technological Leadership

Innovation and technological leadership represent one of JP Morgan's key strengths, underpinning its ability to maintain a competitive edge in the financial services industry. This strength involves the proactive adoption and integration of advanced technologies to enhance operational efficiency, improve client services, and drive business growth. As a leading global financial institution, JPMorgan consistently invests in innovative solutions, ensuring it stays ahead in a rapidly evolving market.

Example:

- The introduction of the LLM Suite in 2024, a generative AI product similar to OpenAI's ChatGPT, showcases JPMorgan's commitment to innovation and technology leadership. This positions the bank as a forward-thinking entity in the financial sector. With 50,000 employees already having access to the LLM Suite, JPMorgan demonstrates its capability to scale new technologies across its vast workforce, enhancing overall operational efficiency.

These are some of the measures that prove how financially strong JP Morgan is. Such financial strength helps JP Morgan attract businesses and make risky decisions that bring great fortune to the bank.

JP Morgan Weaknesses

Weaknesses are the drawbacks that hold an organization from achieving its true potential. Although every organization possesses some weaknesses, businesses try hard to eliminate their weaknesses by converting them into strengths. In this section, we will discuss some weaknesses possessed by JP Morgan.

High Operational Cost

The prime objective of any business is to maximize profit, which is the difference between revenue and costs. Therefore, if any business has higher costs, its profit margins will shrink. Although JP Morgan manages to generate high revenue, high operational costs narrow down the profit margin of JP Morgan.

Since JP Morgan operates in more than 60 countries, it has a high operational cost. Moreover, a large section of the bank's expenses is associated with the salaries it has to give to its large workforce. JP Morgan has 271,025 employees, which contributes to increasing the operational costs of JP Morgan.

High Reliance on One Region

Businesses look forward to expanding their operations in other countries so they don't have to rely on one region to generate revenue. Similarly, JP Morgan bank has also spread its operations in more than 60 countries. However, it still relies heavily on the North American region for revenue generation.

JP Morgan generates revenue from regions such as Asia, the Middle East, Europe, Africa, Latin America, the Caribbean, and North America. However, the bank relies on North America to generate most of its revenue.

Currently, the North American region is responsible for generating 53% of the total revenue of JP Morgan. Such heavy reliance on one region is a weakness of JP Morgan.

Controversies

Businesses avoid controversies since they can decrease an organization's customer base and profits. However, no matter how hard businesses try, they get involved in controversies. Similarly, JP Morgan has been involved in several controversies and lawsuits.

Earlier, JP Morgan had to pay a fine of $200 million to two US bank regulators because gave permission to its employees to use WhatsApp and other platforms to share business details. Other than that, the bank was recently accused of gender discrimination. Such controversies create a negative impact on the image of JP Morgan.

JP Morgan Opportunities

Opportunities are the chances available for an organization to become successful. If these opportunities are availed at the right time, any business can achieve success in the future. In this section, we will analyze the opportunities that are present for JP Morgan.

Increase The International Presence

Businesses look for ways to increase their international presence because it helps them to generate more revenue by increasing their customer base. Similar to other businesses, JP Morgan has an international presence. However, the bank's presence is limited.

JP Morgan is currently operating in more than 60 countries. However, it can increase its operations abroad by setting up its operations in more countries. By doing so, JP Morgan can increase its revenue and customer base.

Reduce Its Reliance on North America

Organizations expand their operations in different parts of the world so they don't have to rely on a specific region for revenue generation. Although JP Morgan's operations are spread in different countries, most of its revenue is still generated from the North American region.

JP Morgan has an opportunity to increase its revenue share from other regions besides North America. As a result, the bank can focus more on other regions, such as Europe and the Middle East.

Growth In The Global Credit Card Market

Commercial banks that offer financial services to their consumers have an opportunity to grow since the usage of credit cards is increasing daily. Since JP Morgan offers several financial and credit services, growth in the credit card market provides an opportunity for JP Morgan to expand.

The credit card market is growing at a decent rate of 2.9%. The reason for this growth is the spread of awareness, which increased the number of credit card users over the years.

JP Morgan Threats

Every business or organization faces threats from its external surroundings. These threats have the potential to limit the growth of an organization. In this section, we will discuss some threats that can impact the operations of JP Morgan.

Global Recession

The world is about to experience a global recession due to post-pandemic demand shock and the conflict between Russia and Ukraine. As a result, economists have predicted that a global recession will soon occur.

This global recession will impact JP Morgan negatively. For example, in case of a recession, the people's living standard will fall, and the customer base of JP Morgan will also fall. Moreover, people will withdraw their money from the bank as the cost of living will skyrocket, and the demand for the financial services provided by JP Morgan will fall too.

Changes In Regulations

Any business feels threatened by the changes done by regulatory bodies because they can hinder the growth of the company. At times, policies made by regulators take away the freedom of businesses to operate freely.

Like any other business, JP Morgan feels threatened by the regulators because regulatory requirements have increased and continue to change, making compliance more costly for financial institutions.

Tough Competition

Businesses are not comfortable in highly saturated markets because a high number of competitors cause a division in the market share, which causes a fall in their profits.

The banking industry in the US is highly saturated due to low barriers to entry. Currently, more than 4,488 banks are operating in the US. JP Morgan has to compete with all these banks, including some big banks such as Bank of America, Citigroup, and Wells Fargo.

To compete in such a competitive market, JP Morgan has to constantly innovate to consolidate its position in the market and, perhaps, take a bite of the fintech industry.

JP Morgan SWOT Analysis: Final Word

JP Morgan is the largest bank in the US, providing financial and investment banking services. The traces of JP Morgan can be traced centuries back. Looking at the success of JP Morgan, we decided to conduct JP Morgan's SWOT Analysis.

In this SWOT analysis, we highlighted the strengths, weaknesses, opportunities, and threats faced by JP Morgan. SWOT Matrix is another way to highlight the internal and external factors affecting the operations of JP Morgan in the form of a SWOT table. This SWOT analysis provided you with an insight into the operations of JP Morgan. Moreover, it also made you aware of how to conduct a SWOT analysis. If you have any confusion, look at some more examples of SWOT analysis.