Ryanair placed an order for 210 Boeing 737s. By 2025, Europe's largest airline group aims to grow traffic to 200 million people per annum. At the same time, Ryanair seeks to maintain lower fares. This SWOT analysis of Ryanair reveals the forces driving these ambitious goals.

Reading this article will increase your business savvy, boost problem-solving abilities, and raise industry awareness. All this in less than 5 minutes.

Here's what this SWOT analysis for Ryanair covers:

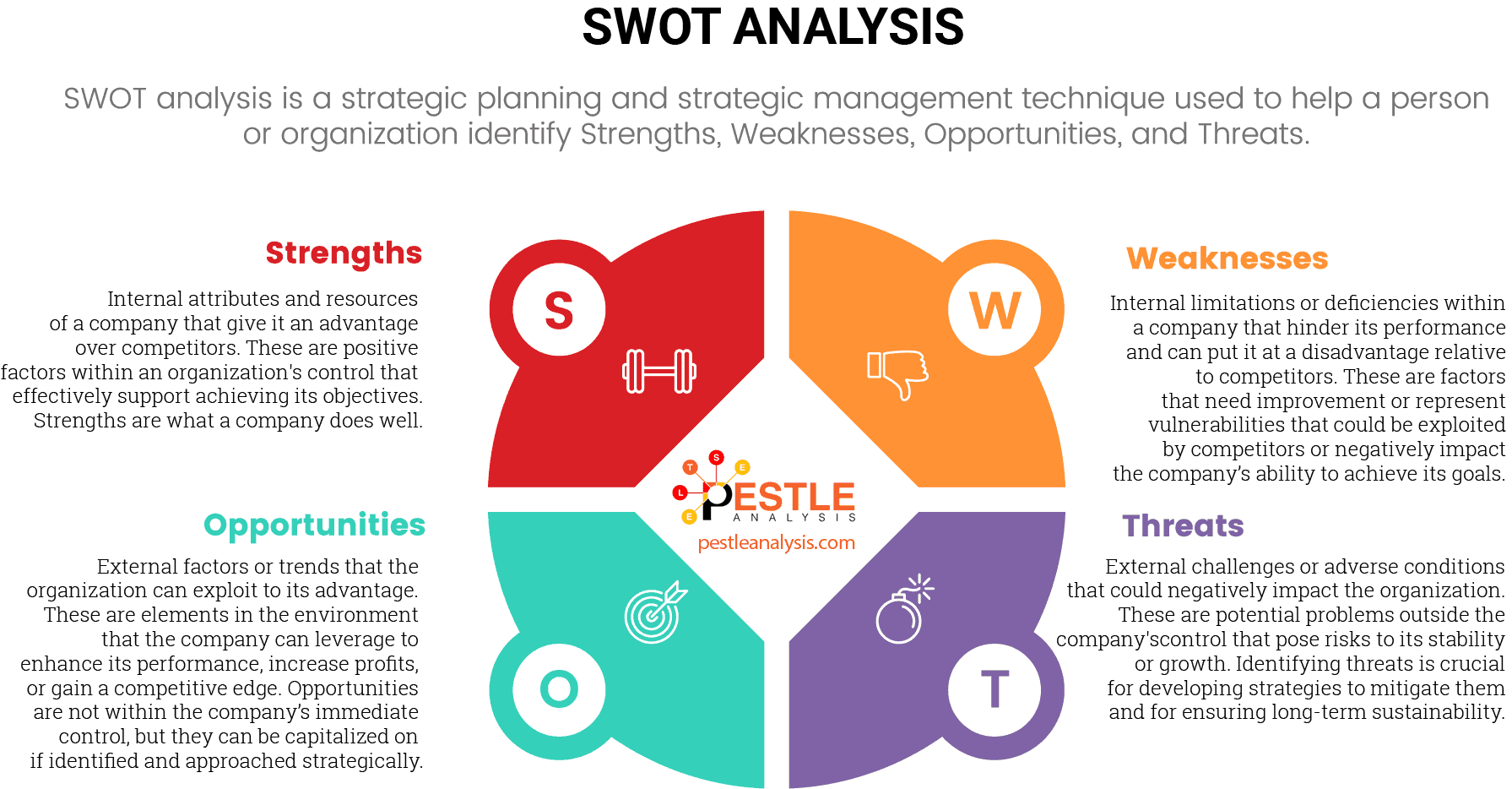

- Strength: Ryanair's strengths cover internal factors driving growth.

- Weakness: Ryanair's weaknesses include internal factors slowing down progress.

- Opportunity: Opportunities are external factors promoting expansion.

- Threat: Threats to Ryanair are external factors blocking development.

If you don't have 5 minutes right now, no problem. Bookmark this article and comeback to it later.

Awesome, you decided to stick around. That's great. Now, let's move to the first aspect of a SWOT analysis - strengths.

Ryanair's Strengths

35 years ago, Ryanair started operations with a 15-seater. The plane was so small, only attendants shorter than 5"2' could work in the tiny cabin. Today, Ryanair and its subsidiaries own 470 aircrafts. Here are the prime movers propelling this growth.

Fleet Strength

Ryanair has a fleet of about 450 aircraft. CEO Michael O'Leary is eager to build the fleet to 600 aircraft. While other airlines are downsizing their fleet, Ryanair, according to Forbes, is negotiating with Boeing for a 737 MAX.

Strong Balance Sheet

In a statement put out to the Irish Stock Exchange, Ryanair states it has year-end cash equivalent of 3.8 billion Euros. In a separate announcement, Ryanair projects a profit of 1 billion Euros in the financial year.

Business Model

While other airline companies desperately cut costs during the pandemic, keeping costs as low as possible is at the core of Ryanair's business model. Specifically, Ryanair keeps costs low by offering non-essential services as add-ons.

Stock Market Performance

Investor's Business Daily upgraded Ryanair's RS Rating to 83. The RS Rating measures the performance of a company's stock within a 52-week period relative to the rest of the marker. A rating of 83 makes Ryanair the safest stocks to buy in the airline sector.

Routes

Ryanair offers 1831 routes, which is the highest any airline in the world offers. American Airlines, at second place, offers 1106. The difference gives Ryanair a dominant lead of nearly 65% more routes than its closest competitor.

Despite hard times, Ryanair is so successful because Ryanair's core strength is its business model. In perfecting the art of operating a low-cost airline, Ryanair has a natural advantage. While some airlines expect the industry to recover by 2023, Ryanair is eager to beat its record of 190 million passengers per annum.

However, it is inaccurate to say that Ryanair is without its problems. In the next section, we'll look at problems plaguing Ryanair.

Ryanair's Weaknesses

Ryanair's biggest competitor is EasyJet. However, the economic crisis has hit EasyJet hard as well. Financial Times reports EasyJet is, for the first time in 25 years, heading for an annual loss. That said, Ryanair's strife has more to do with internal issues than the competitor.

Refunds

Customers are enraged at Ryanair's refund policy. Ryanair has issued only 5% of the refund claims within a legal time frame. Also, customers are unhappy about Ryanair offering them time-limited vouchers instead of a cash refund.

Layoffs and Grounding

Last June, Ryanair grounded 99% of its fleet. The company also cut 3,000 jobs due to restructuring. Meeting ambitious goals of surpassing its performance in 2019, will be an uphill task for Ryanair with 15% of its workforce laid off.

Controversial Positions

Ryanair CEO, Michael O'Leary, said operating an airline with social-distancing is stupid. The comment is just one of the many situations where the CEO has gone against the grain.

Bad Reputation

In a survey of 7901 respondents, Ryanair with a customer score of 40% earned the last place. And Ryanair has been in this position for the last 6 years. The reason for low customer score is Ryanair's murky pricing structure that makes customers wary of hidden costs.

Strikes

Ryanair failed to secure a favorable ruling from the High Court to stop a 48-hour strike, which members of the pilot union announced. 80% of the members of the union expressed dissatisfaction due to ongoing disputes related to pay and working conditions.

Most of the weaknesses affecting Ryanair arises from its business model of keeping costs low. Since the business model is unlikely to change, Ryanair would have to cope with these issues for the foreseeable future.

Despite the weaknesses, the decline in air travel this year may bring some pleasant news. As an industry leader, Ryanair could benefit from the adverse conditions. We'll talk about that next.

Ryanair's Opportunities

IATA predicts passenger traffic will not return to pre-COVID levels until 2024. But not everything is doom and gloom. The slump brings with it some unexpected opportunities. Here are some of them:

Government Assistance

Ryanair is among 53 companies standing to benefit from the Bank of England's COVID Corporate Financing Facility. Under the scheme, Ryanair has taken 800 million euros in lending.

Survival of the Fittest

According to CNN, 20 airlines have shut down or declared bankruptcy. However, Ryanair has proven its resilience across two Gulf Wars, 9/11 crisis, 2008 meltdown, and skyrocketing fuel prices. In a way, this crisis could help Ryanair by eliminating Ryanair's competition.

Talent Availability

With thousands of skilled professionals such as pilots, ground staff, cabin crew, and engineers competing to re-enter employment, Ryanair has the opportunity to hire the best available talent.

Aviation Industry Slump

Airbus, the largest airliner manufacturer in the world, plans to shed 15,000 jobs. The COVID travel restrictions affected airline manufacturers direly. However, this could be a chance for Ryanair to acquire aircrafts at a cheaper price.

Stock Market

Morgan Stanley predicts Southwest Airlines's stock to soar after governments lift travel restrictions and air traffic returns to normal. Ryanair, Southwest's European equivalent, could expect a similar surge in stock price.

If you look at how Ryanair benefits from the current situation, you will realize that the main advantage Ryanair has is its resilience. While others in the industry crumble, Ryanair could emerge from the dust stronger than ever.

But Ryanair needs to be cautious. Opportunities go hand in hand with threats. Therefore, Ryanair must plan to handle lurking dangers beyond its control. Let's talk about those dangers next.

Ryanair's Threats

A research paper from the Journal of Airtransport Management says the airline industry's recovery is not completely within its own hands. The industry must depend on support from the government and other agencies to get back on its feet. Let's look at some of these dependencies.

Government Regulations

Ryanair has no control over government regulations. For instance, the Government of Italy threatened the suspension of all aerial activity in Italy's national airports over Ryanair's violation of the country's COVID norms.

COVID-19 Restrictions

Confusion and inconsistency are chief characteristics of how many countries are handling the COVID crisis. In the absence of a formal and consistent recovery plan, the airline industry might be taking a step back with every step forward.

Video Conferencing

An article in the Chicago Booth Review estimates businesses to conduct half of its meetings with external clients over video conferencing. This would threaten the revenue stream from business travelers.

Vaccine Availability

The CEO of United Airlines shares his concerns over air traffic not returning to normal until a vaccine is widely available. He hopes that we reach the milestone by the end of 2021. And the people need to feel safe in a crowd. Thus prolonging return to normalcy.

Air Travel Confidence

A roundtable of the best minds in the Middle East's aviation sector discussed measures to boost customer's confidence in air travel. Although they concluded that the confidence will come to normal, they also said it would take a massive, coordinated effort.

Ryanair operates across 40 countries. Each country has its own plans for dealing with the pandemic. As a result of this inconsistency, Ryanair isn't able to form a coherent recovery strategy. This inconsistency is Ryanair's biggest threat.

Now that we have evaluated the strengths, weaknesses, opportunities, and threats, let's put all this together to see Ryanair's outlook in the near future.

Final Thoughts on Ryanair SWOT Analysis

Ryanair has a stable business model. However, the business model creates challenges in customer and employee relations. But the model has yielded steady returns to stakeholders and facilitated consistent growth over the last few decades. Therefore, the future outlook for Ryanair is positive.

Now, when we look at the airline industry, the clear and present danger is COVID-19. As a result, the entire industry cut costs. But keeping costs low has been a fundamental ethos of Ryanair's operations. Thus, Ryanair is the best-prepared airline to cope with the aftershocks of the pandemic. This is what is unique about Ryanair.

This SWOT analysis reveals the benefits of adopting a strong business strategy, executing it, scaling it, and defending it. There's a lot you can learn from Ryanair, its success, and its resilience. We hope you have benefited from this reading.

If you would like to learn what is SWOT analysis, start with our article on how to do a SWOT analysis. You will also find four handy SWOT analysis templates for your use. And if you would like to read other SWOT analysis examples like this one, make sure you check out our SWOT analysis library.