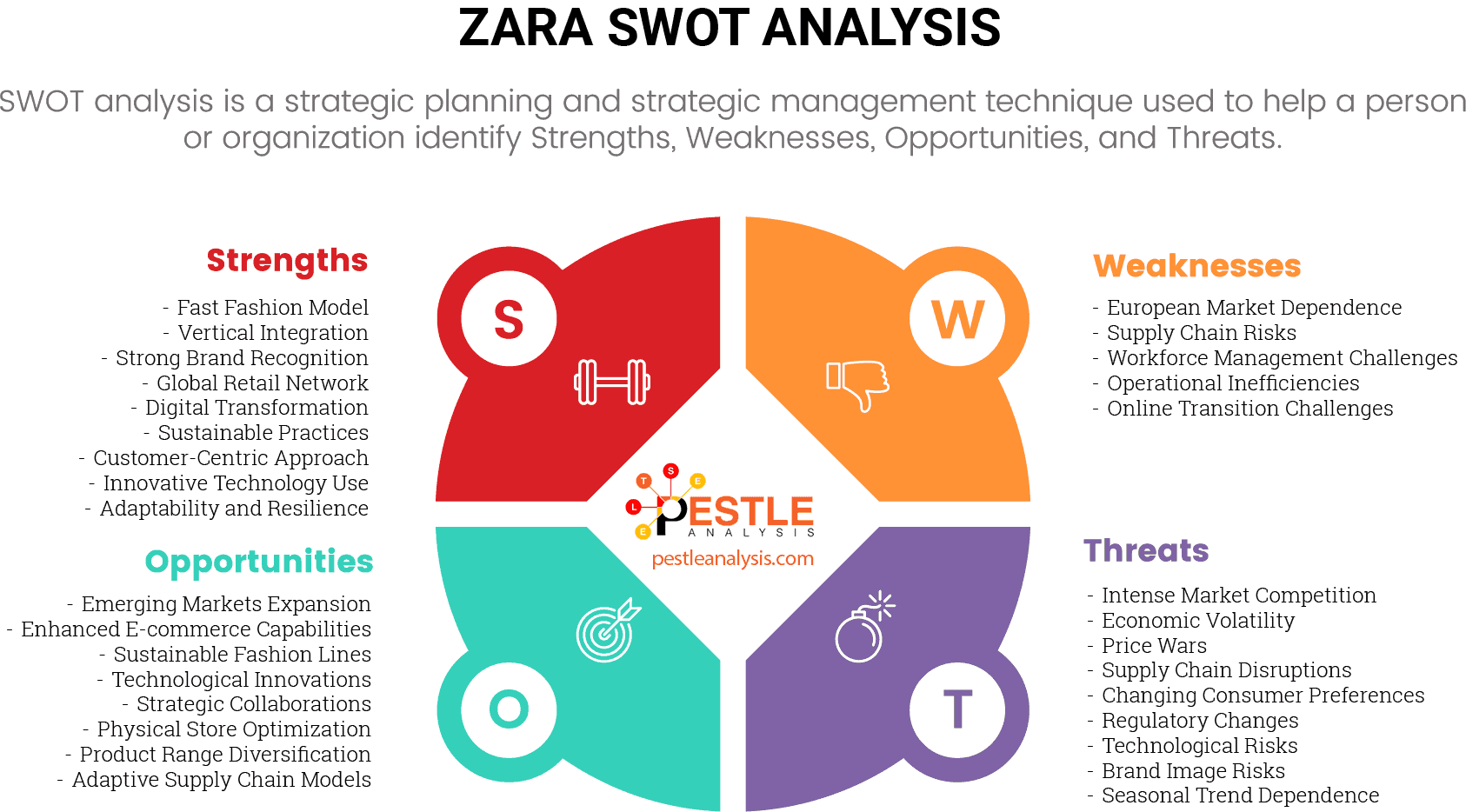

In this article, we'll walk you through a SWOT analysis for Zara.

What makes Zara such a popular brand? Well, our SWOT analysis for Zara helps you learn why. Here's what the SWOT analysis covers:

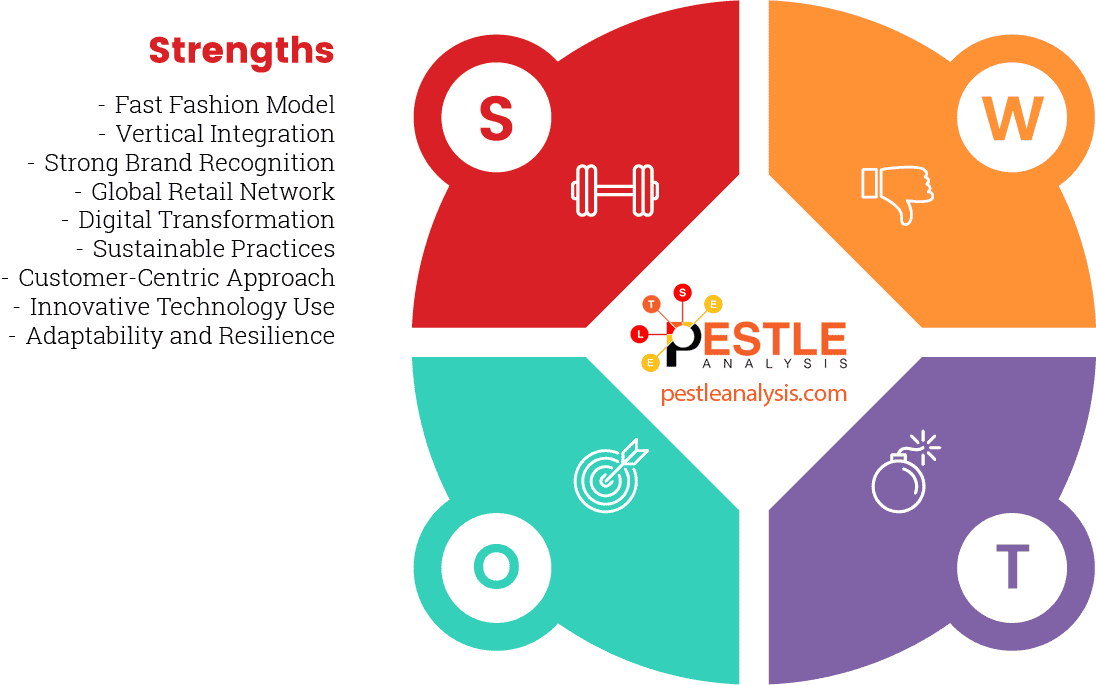

- Strengths: Internal factors enabling Zara's growth.

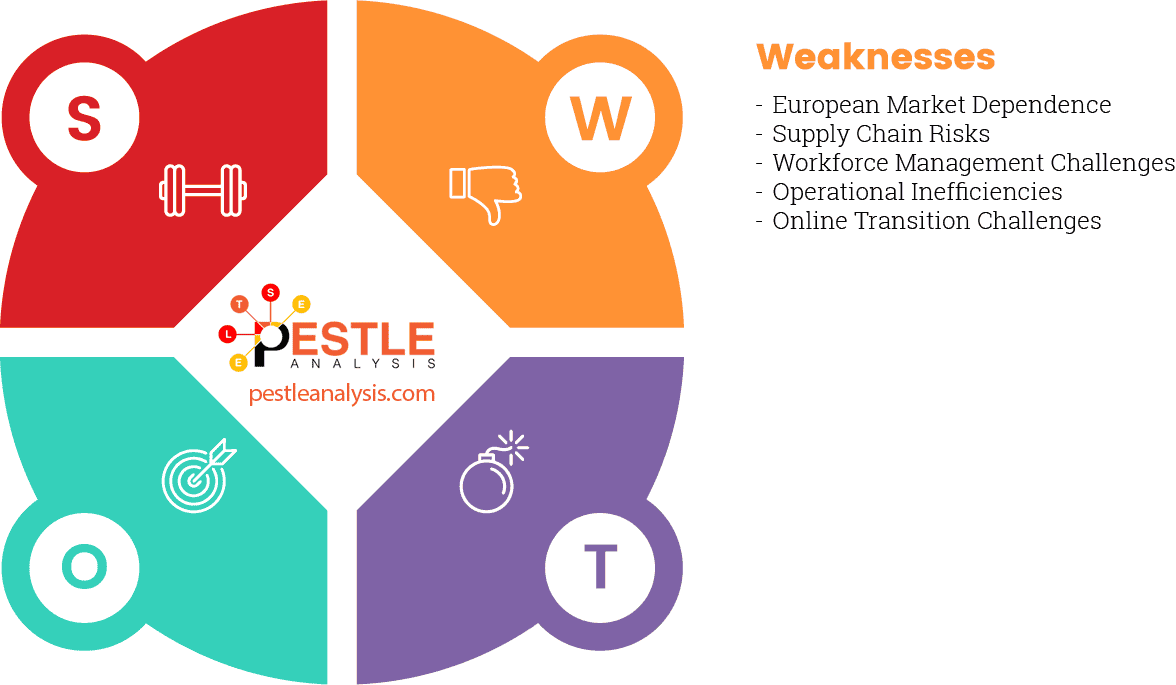

- Weaknesses: Internal factors hindering Zara's progress.

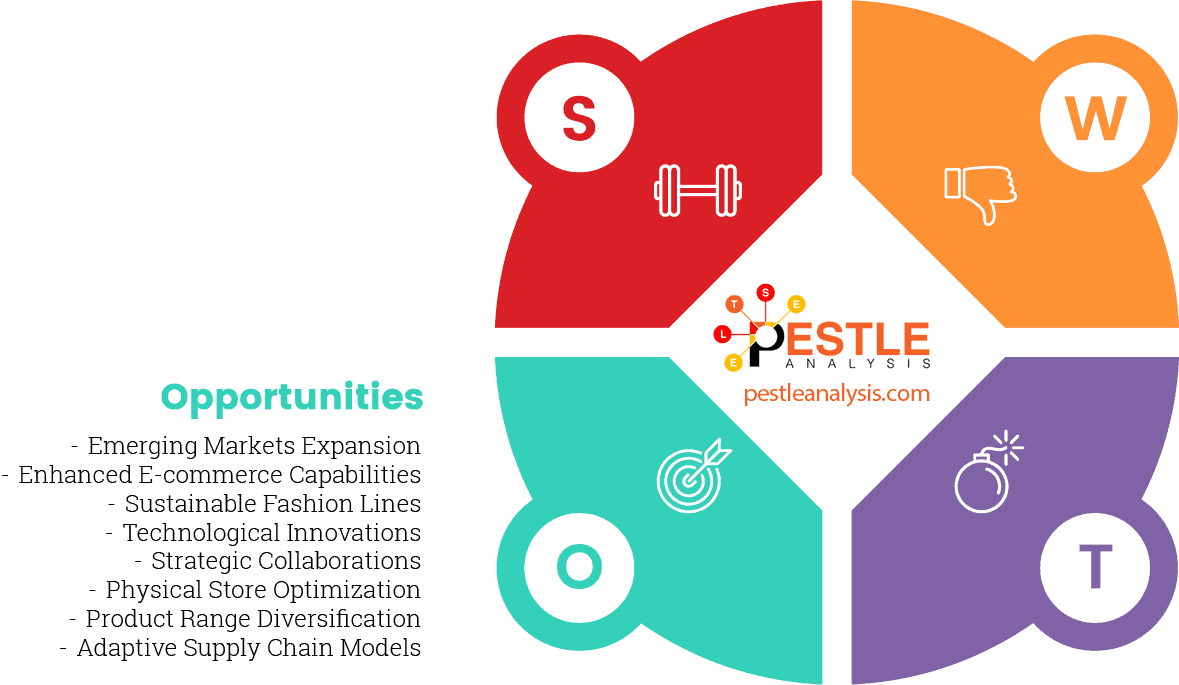

- Opportunities: External factors aiding Zara's rise.

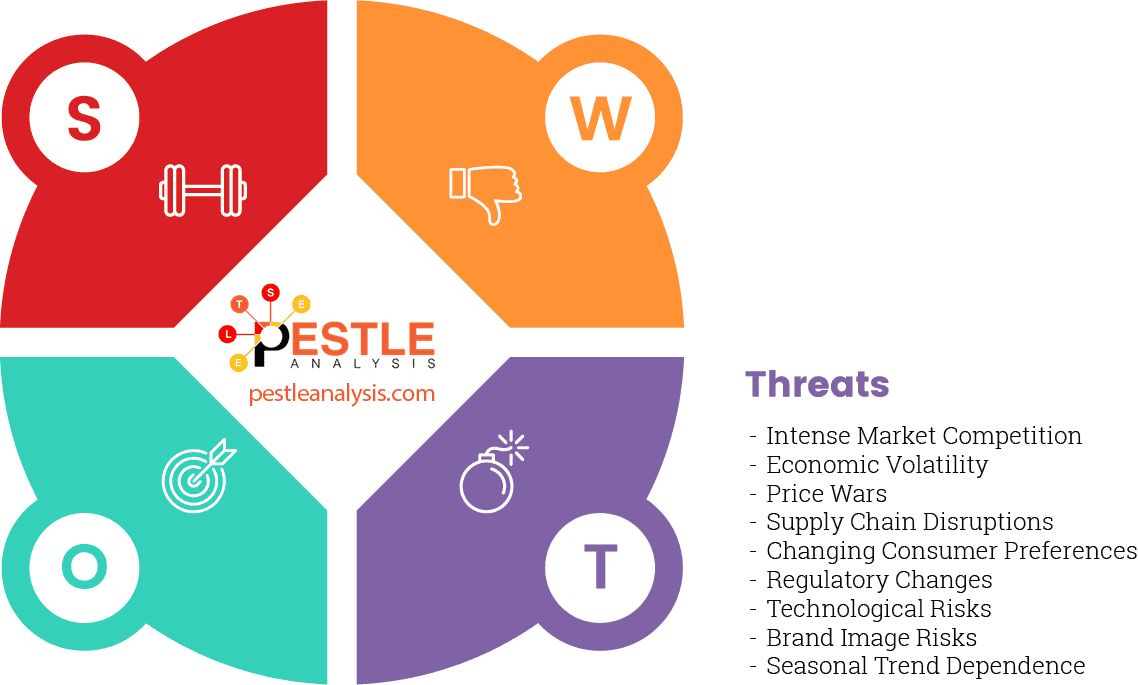

- Threats: External factors pulling Zara down.

Reading this SWOT analysis helps you upgrade your business IQ and develop your problem-solving skills. Interested in getting smarter? Just five minutes will do it. Shall we start?

Zara: Company Overview

Inditex, the world's biggest fashion retailer owns the brand Zara. In 1975, Amancio Ortega, Inditex's founder, opened the first Zara store in Spain. Since 1975, Zara has become a dominant presence in the fashion industry.

Back in 2019, with 2,240 stores across 96 countries, Zara brought home €19.5 billion. Contributing 70% of Inditex's revenue in 2019, Zara was Inditex's crown jewel. As of 2023, Zara reported substantial revenues, amounting to over €26 billion from sales in its almost 3,000 stores worldwide, highlighting its dominance within the Inditex Group and its substantial market presence.

The company has seen a robust recovery in its online sales post-pandemic, with a reported increase to US$54.8 billion in 2023, surpassing the pandemic peak of 2021. This growth trajectory is anticipated to continue into 2024.

Zara Strengths

Fast Fashion Model's Pioneer Advantage

Fast-fashion focuses on designing, producing, and selling clothes as soon as they identify a trend. In traditional fashion, the process takes months; Zara does this in 3 weeks. As a pioneer, Zara has the most evolved strategy and management practices in running the supply chain.

Global Retail Network

Zara sells in 202 markets and has stores in 96 of them. With 2249 stores, Zara has the most number of fashion retail stores in the world. The number is almost twice the number of retail stores that Nike has, which has the second-highest number of retail stores. Zara operates a vast network of physical stores worldwide, although it has been optimizing this network to better integrate digital and physical sales channels.

Supply Chain's Vertical Integration

Zara refreshes its online and retail collections two times a week. Zara's 10 logistic centers deliver to any location in the world within 48 hours. Inditex also has an in-house team that designs software to double the speed at which the company dispatches orders. Owning much of its supply chain enables Zara to control production costs, reduce lead times, and enhance its ability to respond to market changes swiftly.

Strong Brand Recognition

As a global brand, Zara enjoys high brand awareness and customer loyalty across key markets, including the US, UK, and Europe.

Sustainable Practices

Zara has been integrating sustainability into its operations, appealing to the growing segment of environmentally conscious consumers

Design Team

Inditex has a team of 700 trained designers (2020) who transform the customer's desires to designs. The team of designers outputs 50,000 creatives a year (2020). And, it takes them just 3 weeks to get the designs from the drawing board to the stores.

Customer-Centric Approach

Zara’s strategy includes listening to customer feedback and adapting its offerings quickly to meet changing consumer preferences, enhancing customer satisfaction and loyalty

Digital Transformation

Inditex invested $3 billion to bolster its online sales. The investment focuses on developing an engaging online buying experience and integrating existing physical infrastructure.

Innovative Technology Use

The adoption of technologies like RFID for inventory management and advanced digital store features supports operational efficiency and improved customer service.

Adaptability and Resilience

Zara has shown a strong ability to adapt to various market challenges, including shifts in consumer behavior and economic downturns, as evidenced by its quick recovery and continued growth in online sales during and after the COVID-19 pandemic.

Zara is so successful because it has mastered the game of fast fashion. However, due to growing concerns about the environment and ethics, fast fashion can be a double-edged sword. We’ll cover this and more in our next section on Zara’s weaknesses.

Zara Weaknesses

What makes Zara unique in the world of fashion is its commitment to revising its collection every two weeks. This commitment gives Zara a place at the top of the industry. But the edge comes at a price. Here’s more:

Supply Chain Risks

Interestingly, the trend that helped propel Zara to the top is the cause of its most pressing weakness. With the focus on sustainability increasing among customers and policymakers, Zara's weakness is balancing sustainability with fast fashion. Despite the benefits of its fast-fashion model, the quick turnaround times can lead to supply chain issues, such as overreliance on specific geographies for manufacturing, which might be affected by political instability, labor disputes, or natural disasters.

Operational Inefficiencies in Scaling Down Physical Stores

The pandemic accelerated Zara's plans to limit the number of physical stores. Online sales helped Zara climb out of a massive drop in sales because of COVID-19-related causes. However, even with online sales picking up, the sales for 2020 were only at 89% of what it was in 2019. As Zara shifts more towards online sales, the downsizing and optimization of its physical store network must be managed carefully to avoid operational disruptions and maintain customer experience.

Challenges in Online Shift

Despite strong growth in online sales, transitioning from a primarily brick-and-mortar model to a more digital-focused model involves significant challenges in logistics, customer service, and digital marketing.

High Dependence on the European Market

Zara has 103 stores in the US (March 2024). This accounts for only 3.3% of Zara's 3,000 stores. However, the US is the biggest apparel market in the world. And the Asia-Pacific accounts for 38% of the apparel market share. Zara's presence in both geographies is weak.

Workforce Management Challenges

Inditex works with 1520 suppliers across 7108 factories (2020). Although Inditex deserves credit for creating a rigorous code of conduct, a large gap exists in enforcing the code. The rapid expansion and the nature of fast fashion require a large and flexible workforce, which can lead to challenges in managing labor relations and maintaining quality working conditions. Criticism regarding labor practices can affect the brand’s reputation. An issue, as reported by Buzzfeed, regarding the treatment of workers in Myanmar points to this gap.

Zara Opportunities

One of the biggest advantages Zara has is its experience in capitalizing on fashion trends quickly. This advantage puts Zara in the right place to leverage opportunities on the horizon. Some of these opportunities are:

Adaptive Supply Chain Models

Developing more responsive and flexible supply chain models to quickly react to market changes can help Zara maintain its competitive edge in fast fashion. This might include closer integration with local suppliers or more onshore manufacturing to reduce lead times and increase responsiveness. Customers visit Zara's shops an average of 17 times a year. This is because Zara responds to trends as soon as they emerge. Right now, Zara delivers a trend from start to finish in just 2 to 3 weeks. However, in the future, Zara could shorten the cycles even more.

Physical Store Optimization

While reducing physical store numbers, Zara can transform existing stores into experiential hubs that offer unique in-store experiences, such as pop-up events or technology-driven personal shopping experiences, which can enhance brand engagement and customer loyalty.

Sustainable Fashion Line Expansion

According to the Sourcing General, over 1/3rd of Millennials and Gen Z look for "sustainable" and "environment friendly" labels on clothes. Together, the two groups account for 50% of the population. So, Zara must listen and respond to this growing need. With growing consumer interest in sustainability, Zara has the opportunity to expand its sustainable fashion lines. This could include using more eco-friendly materials and processes, which would not only meet consumer demands but also comply with global environmental regulations.

Diversification of Product Range

Expanding into related product lines like cosmetics, home decor, or even technology gadgets could open new revenue streams. Leveraging its brand strength to enter new categories could attract a broader customer base.

Expansion in Emerging Markets

Zara can explore further expansion into emerging markets where there is significant growth potential for retail. Countries in Asia, Africa, and Latin America with growing middle classes offer new customer bases for Zara's fashion-forward yet affordable products.

Resale

The re-sale market, currently valued at $28 billion today, is predicted to grow to $64 billion in 5 years. Integrating a re-sale strategy to their current platform would allow customers to purchase more with less wastage. This encourages consumerism while supporting sustainability.

Strategic Collaborations

Collaborating with designers, celebrities, or influencers could generate buzz and attract different customer segments. Limited edition collections can create a sense of urgency and exclusivity, driving sales and enhancing brand prestige. Unbox Social says influencer marketing is the most effective strategy for promoting lifestyle brands. Zara's success with the #DearSouthAfrica campaign involving 60 micro-influencers engaged 8 million people. This should be a model for the future.

Enhanced E-commerce Capabilities

Continuing to build on its online platforms can help Zara capture more of the e-commerce market share. Improving user experience, enhancing mobile commerce, and integrating advanced technologies like AR for virtual try-ons could attract a larger online customer base.

Technological Innovations

Investing in technology to streamline operations, such as advanced inventory management systems, AI for customer personalization, and robotics in warehouses, could improve efficiency and customer satisfaction. Currently (2020), Inditex is working with AI and Big Data companies to create an AI-enabled system that predicts consumer behavior. However, the current system is still in its testing stage. When such a system goes online, Zara will have the unrivaled capability to predict and fulfill customers’ needs. Collecting data and segmenting the customer base after analyzing the data is becoming easier than ever before, thanks to AI. This allows for providing personalized suggestions to customers. Zara should capitalize on this technology.

Zara Threats

Zara’s biggest competition in the traditional sense would be H&M. However, in the online space, Zara faces competition from multiple businesses. But competition is just one of the threats to Zara.

Intense Market Competition

Zara operates in a highly competitive industry where both traditional retailers and online fashion retailers are constantly vying for market share. Brands like H&M, Uniqlo, and online giants like Shein and Amazon are major competitors that offer similar styles at competitive prices. China's fast-fashion giant, Shein, is the world's biggest fashion retailer with a purely online presence. In September 2020, the Shein app saw 10.3 million downloads. Zara, with only 2 million downloads in the same period, must watch out for its rivals in the digital arena.

Price Wars

Fast-fashion, Zara's primary niche, brings the latest trends from the ramp to the customers quickly and at low costs. However, the industry is vulnerable to imitators waging price wars to leech off from Zara's line.

Dependence on Seasonal Trends

Zara’s profitability heavily depends on its ability to predict and react to fast-changing fashion trends. Failure to accurately predict these trends can result in stock accumulation and markdowns, reducing overall profitability

Economic Volatility

Global economic instability, including inflation, recession risks, and fluctuating currency values, can affect consumer spending habits, especially in Zara’s key markets such as Europe and the United States

Supply Chain Disruptions

Political instability, natural disasters, or pandemics can disrupt supply chains. Given Zara's reliance on a global supply chain, disruptions could lead to significant operational challenges and financial losses. In the first quarter of 2020, Inditex reported a 44% drop in sales. Inditex's report states the closure of 88% of its stores because of the Coronavirus lead as the central reason for the drop in sales.

Regulatory Changes

Tightening regulations on environmental and labor practices can pose significant compliance costs. Countries are increasingly implementing stricter environmental laws that could affect how Zara manufactures and distributes its products.

Changing Consumer Preferences

There is a shift towards more sustainable and ethically produced fashion, which poses a threat to Zara’s fast-fashion model. Consumers are increasingly favoring brands that offer transparency and sustainability in their production processes. The use-and-throw attitude people had towards fashion is changing. People are conscious of the impact of fashion on the environment and people. Thus, Zara would have to push towards making fast-fashion a sustainable business - economically and ecologically.

Technological Changes and Cyber Threats

As Zara continues to expand its digital footprint, it faces the dual threat of needing to continuously innovate to keep up with technology and protect itself against cyber threats, including data breaches and IT disruptions.

Brand Image Risks

Any negative publicity regarding labor practices, environmental impact, or quality issues can damage Zara’s brand reputation quickly, especially in an era where social media can amplify such issues globally within hours

Recommendations based on our Zara SWOT Analysis

Recovering from the COVID-19 crisis and strengthening online presence has been Zara's priority. Inditex's financials showed signs of recovery and the management was optimistic about boosting online sales. So, we could say Zara had things under control.

Well, the pandemic has accelerated the growth of online shopping. In the immediate future, Zara must consolidate its footing in the digital and physical space. Zara has got many things right in its rise to the top of fashion retail. The question is - can Zara do the same online?

From this SWOT analysis for Zara, we hope you have seen how creativity and commitment to customers strengthen a brand in adversity. Here's the takeaway: Get in touch with your audience, build a strong relationship with them, and give them what they want.

More specifically, here are several strategic recommendations to help Zara enhance its market position, address weaknesses, and mitigate potential threats:

- Boost Online Experience: Invest further in AI and technology to enhance e-commerce platforms for better personalization and customer service.

- Expand Eco-Friendly Lines: Increase offerings in sustainable fashion to meet consumer demands and environmental standards.

- Optimize Use of Technology: Implement RFID and automated systems for improved inventory and trend forecasting.

- Market Diversification: Focus on expanding into emerging markets to decrease reliance on European markets.

- Supply Chain Flexibility: Develop nearshoring and diversify suppliers to improve supply chain resilience.

- Labor Standards Improvement: Enhance ethical labor practices through stricter audits and increase transparency.

- Revamp Store Experiences: Integrate digital tools like virtual try-ons in physical stores to enrich shopping experiences.

- Engage in Partnerships: Collaborate with tech firms, designers, and celebrities to refresh product offerings and attract new customers.

- New Product Categories: Consider exploring new categories like home decor or sportswear to broaden market reach.

- Trend Sensitivity: Invest in continuous market research to stay responsive to fast-changing fashion trends.

- Enhanced Cybersecurity: Prioritize robust cybersecurity to safeguard consumer data and enhance trust.

- Proactive Regulatory Adaptation: Stay ahead of environmental and labor regulations to ensure compliance and industry leadership.

SWOT analysis is the best way to learn from the successes of the business world. We've put together many of them here at PESTLEanalysis. Here are a couple of them that make sense, having finished today's analysis of Zara:

- SWOT analysis of Inditex, Zara brand's owner

- SWOT analysis of the fashion industry

- PESTLE analysis of Zara that compliments today's SWOT analysis

And here is more analysis of some of Zara's competitors to check out: