Southwest Airlines is a low-cost carrier that distinguishes itself from other airline companies through its low-cost fares.

Despite being an airline known for its low cost, Southwest airlines operated profitably from its inception in 1967 to 2019. But when the pandemic hit, Southwest’s profits plummeted, leading the company to its first and only loss in over 50 years of operation.

So, what was behind Southwest’s success streak? What did it do to recover from a 59% drop in profit? And what is Southwest doing to recover from this crisis?

Well, this Southwest Airlines SWOT analysis will clarify everything and fill in the blanks of the PESTLE Analysis of Southwest Airlines.

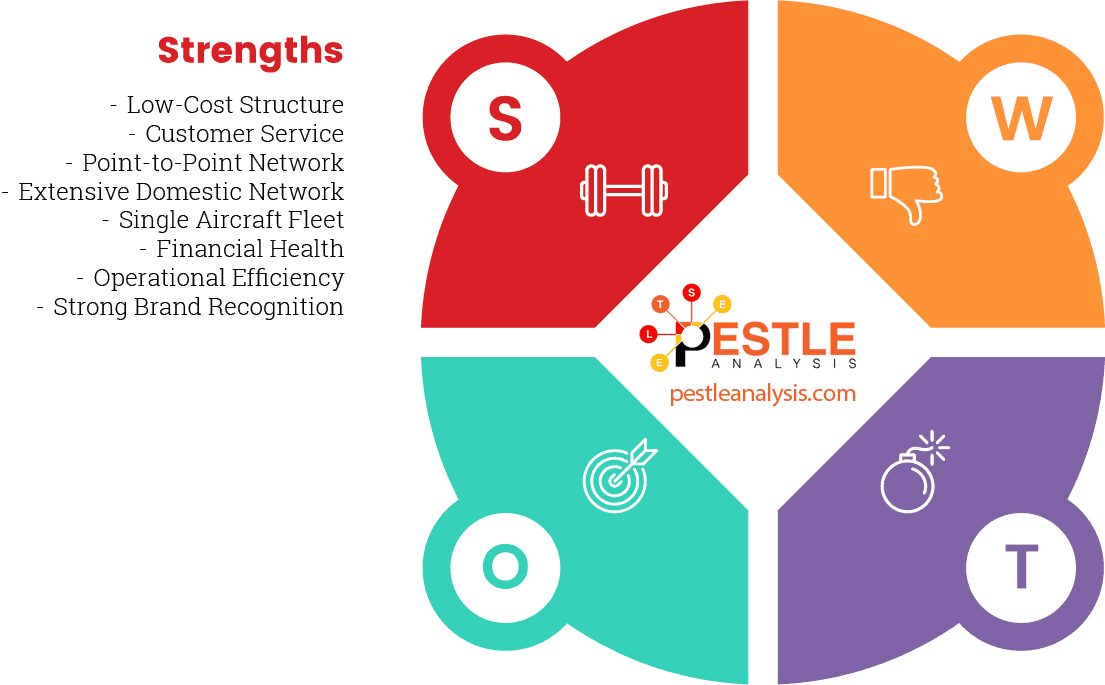

SWOT Analysis of Southwest Airlines

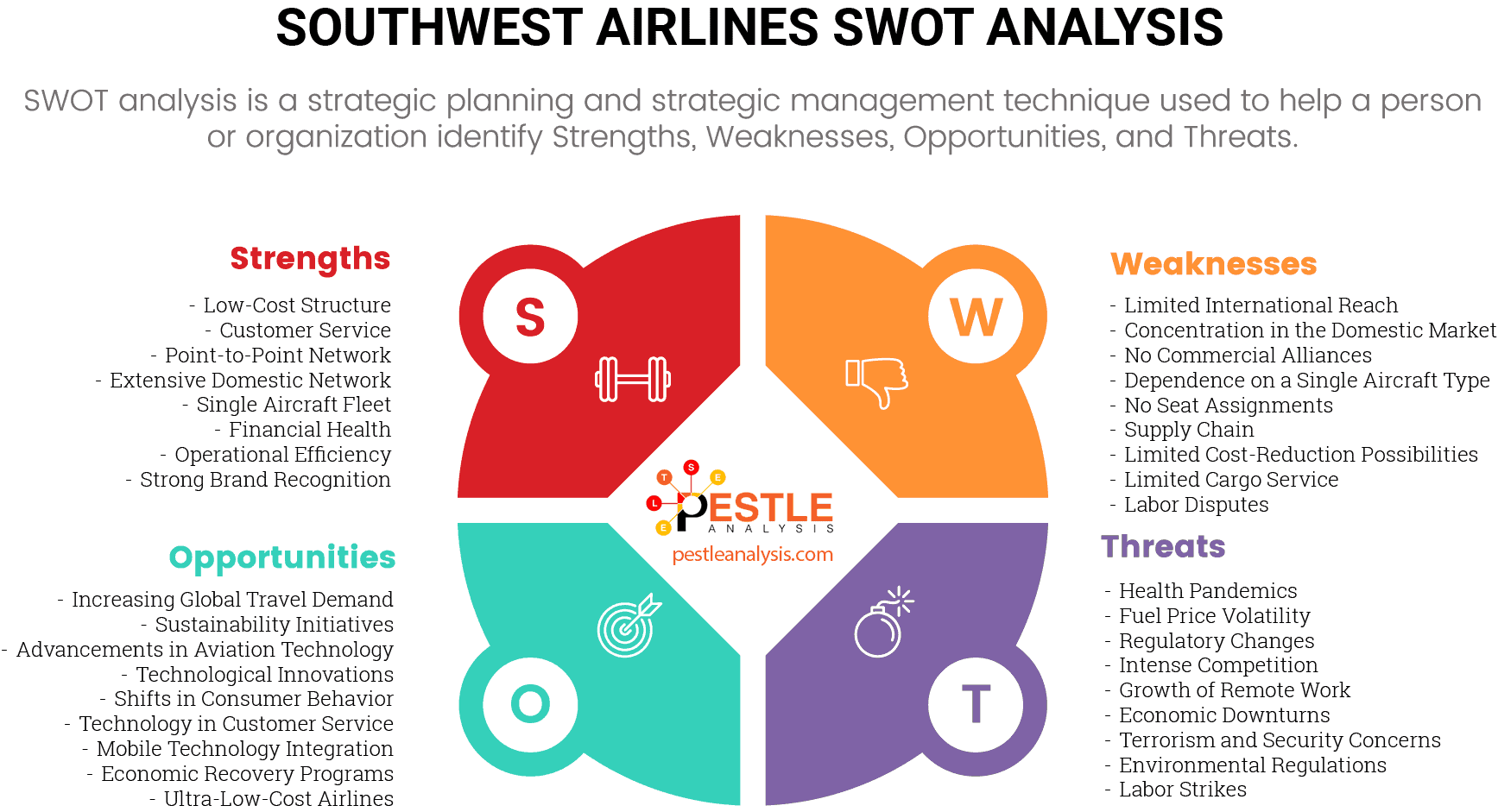

In this SWOT analysis, Ι will explore:

- Strengths - Internal factors supporting Southwest’s growth.

- Weaknesses - Internal factors hindering Southwest’s progress.

- Opportunities - External factors that may help Southwest strengthen its position in the market.

- Threats - External factors that may weaken Southwest’s position in the industry.

For Southwest Airlines, a major U.S. airline known for its unique management style and customer service, we can begin by identifying some key strengths.

Southwest Airlines strengths

The main strengths of Southwest Airlines are its low-cost business model and point-to-point routes. In addition to these, Southwest Airlines has taken aggressive measures to increase its liquidity. As a result, it has added a strong balance sheet to its arsenal of strengths.

Here’s an overview of Southwest’s strengths:

- Low-Cost Structure: One of the lowest-cost operators in the airline industry, which helps in keeping fares low and competitive. Southwest Airlines uses three main measures to reduce its operating costs. The first of these measures includes implementing a point-to-point route structure rather than a hub-spoke route structure. In addition to this, Southwest flies only one type of aircraft. Lastly, Southwest improves operation efficiency by reducing the headcount and increasing the efficiency of employees needed to run operations.

- Customer Service: Known for its friendly service and free checked bags, Southwest often ranks high in customer satisfaction among U.S. airlines. No fee for flight changes and free checked bags are significant benefits that attract customers.

- Point-to-Point Network: Traditionally, airline companies operate the hub-spoke model. In this model, the airline concentrates its resources on major cities - the hubs. Southwest Airlines breaks this model. Instead, it operates scheduled flights between secondary or downtown airports. These airports are less congested, leading to high asset utilization.

- Extensive Domestic Network: It covers a wide network across the United States, offering extensive national connectivity.

- Single Aircraft Fleet: Southwest exclusively flies the Boeing 737. The single aircraft policy simplifies the operation of the fleet and training of the staff. This decision reduces operational expenses and improves efficiency.

- Financial Health: Historically, Southwest has maintained strong profitability and has a robust balance sheet despite some challenges. As of 2024, the company reported a liquidity of $12.5 billion, which comfortably exceeds its total long-term debt of $8.0 billion. For the first quarter of 2024, Southwest experienced a net loss of $231 million, a slight improvement over previous projections. This was accompanied by a record operating revenue for the quarter, demonstrating the airline's strong revenue-generating capability despite its losses.

- Operational Efficiency: Southwest is known for quick turnaround times and high aircraft utilization, helping to keep costs down. Southwest has also benefitted from its proactive fuel hedging policy, which has protected it against fuel price volatility in the past. The airline routinely adjusts frequencies in its existing routes while adding new routes and itineraries. The company also eliminates less profitable routes. The ongoing optimization of existing routes, adding new routes, and eliminating unprofitable routes create a winning formula for maintaining low operating costs and high operational efficiency.

- Strong Brand Recognition: Southwest is one of the most well-known low-cost airlines in the United States.

- Southwest Airlines is well-known for its "Transfarency" policy, which promises no hidden fees, a concept that strongly resonates with consumers and sets it apart from competitors. This transparent approach to pricing is a core part of its brand, making it highly recognizable and appreciated among U.S. travelers.

- Employee Relations: Southwest has a unique culture that values and motivates its employees, leading to high job satisfaction and low turnover rates.

- Southwest is renowned for its positive work culture and strong employee relations. One example is the profit-sharing program, which has been in place since 1974. In February 2020, Southwest announced that it would be sharing $667 million with its employees through this program, which was about 13.2 percent of each eligible employee's annual salary.

- Loyal Customer Base: The airline has a loyal customer base, thanks to its Rapid Rewards loyalty program. This loyalty program offers benefits such as unlimited reward seats, no blackout dates, and points that do not expire, making it highly attractive to frequent flyers.

- Strong Safety Record: The airline has a strong safety record, which is a critical factor for travelers when choosing an airline.

- Strategic Acquisitions: The acquisition of AirTran Airways expanded its market presence and route network.

- Community Engagement: The airline is actively involved in various community and charitable initiatives, enhancing its corporate image.

- One of its key programs is the "Southwest Airlines Heart of the Community Grants," which supports the creation of vibrant, community-led public spaces in partnership with Project for Public Spaces. The airline also has a longstanding relationship with the Ronald McDonald House, providing travel assistance to families dealing with serious illnesses.

- Innovative Marketing: Southwest is known for its creative and humorous marketing campaigns that resonate well with consumers.

- A notable campaign was the "Wanna Get Away" ads, which humorously depicted people in embarrassing situations, suggesting that Southwest could offer an escape at a low cost. These ads were not only memorable but also effectively communicated the value proposition of the airline.

Southwest Airlines managed to pull through 2020 during COVID-19 without eliminating any of the destinations it serves. The company also absorbed the impact of the downturn quite well with an adjusted balance sheet leverage of 56% at the end of 2020.

However, the airline industry is hyper-competitive. Therefore, its success in the years to come will not only depend on how well it leverages its strengths but also on how well it addresses its weaknesses.

In the next part of the article, I’ll explain the major weaknesses of Southwest Airlines.

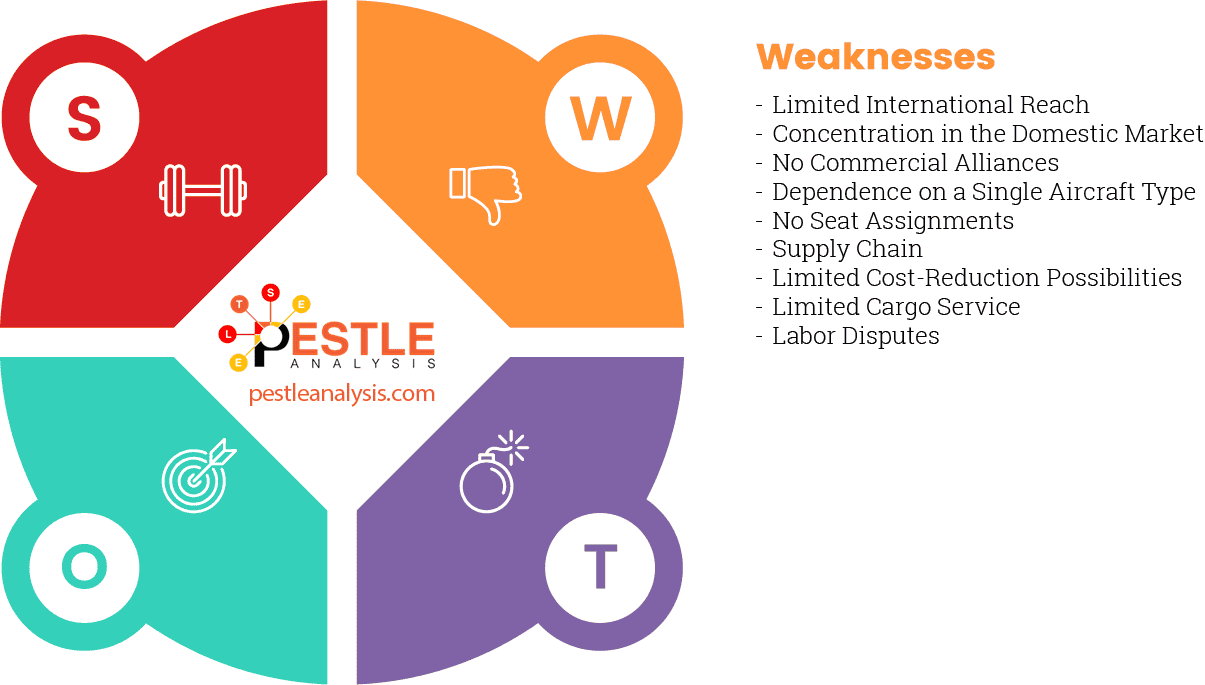

Southwest Airlines weaknesses

The biggest weakness of Southwest Airlines is its inability to remain competitive in the face of other airline companies adopting cost-cutting measures because of the pandemic. In addition to this, Southwest’s destinations and passenger amenities are falling short of those its competitors offer.

Here’s an explanation of Southwest’s weaknesses:

- Limited International Reach: Southwest primarily operates within the United States, with limited international flights, potentially missing out on global market share. Southwest Airlines has a strong network of point-to-point routes in the US. However, its competitors have more extensive routes within the US and in the international markets. At the end of 2020, Southwest served 107 destinations. However, its rival Delta and its alliance partners serve 900 destinations in 140 countries.

- Concentration in the Domestic Market: High exposure to the U.S. market makes Southwest vulnerable to domestic economic downturns.

- No Commercial Alliances: Many of Southwest’s competitors have formed commercial relationships. These relationships allow Southwest’s competitors to provide more destinations to their patrons than Southwest can.

- Dependence on a Single Aircraft Type: Relying mostly on Boeing 737s limits flexibility in capacity management and route customization. Southwest’s single aircraft policy limits passenger amenities to what the Boeing 737 can offer. Other airline companies operate aircrafts that have a larger carrying capacity and better passenger amenities. For instance, Southwest flights don’t offer premium seating facilities such as first class or business class. Southwest's lack of a business class may deter some higher-paying business travelers.

- No Seat Assignments: The open seating policy can be a deterrent for those who prefer pre-assigned seating.

- Supply Chain: Southwest relies on Boeing for spare parts. The reliance on a single company creates supply chain bottlenecks. The prolonged delays in restoring Southwest’s fleet of grounded Boeing 737 MAX highlights the problems of Southwest’s sole reliance on Boeing.

- Limited Cost-Reduction Possibilities: Prior to the pandemic, Southwest’s low-cost business model gave it an edge in the airline industry. However, after the pandemic, several airline companies resorted to similar measures to remain operational. As a result, Southwest lost its advantage. What’s worse, the company is struggling to find further opportunities for cost reduction.

- Limited Cargo Service: Southwest does not have a significant cargo business, unlike many competitors, missing out on this revenue stream.

- Labor Disputes: Although employee relations are generally strong, Southwest has faced labor disputes and union tensions, which can disrupt operations.

- In early 2023, Southwest's mechanics disputed contract terms, highlighting ongoing union negotiation challenges.

- Operational Disruptions: As seen in past technical outages, operational disruptions can severely impact customer trust and operational efficiency.

- The massive flight cancellations during winter 2023, which were partly blamed on outdated technology, seriously impacted Southwest's operations and reputation.

- Aging Aircraft Fleet: Maintenance costs and efficiency losses from an aging aircraft fleet.

- Market Share Limitation: As a low-cost carrier, competing for market share with full-service airlines can be challenging without diversifying the service offerings.

While it may take a decade for the airline industry to return to normal, airline companies must face intense competition on the road to recovery. However, the future isn’t bleak. These turbulent times present several opportunities for Southwest. Capitalizing on these opportunities could give Southwest a significant edge in the industry. I will discuss these opportunities next.

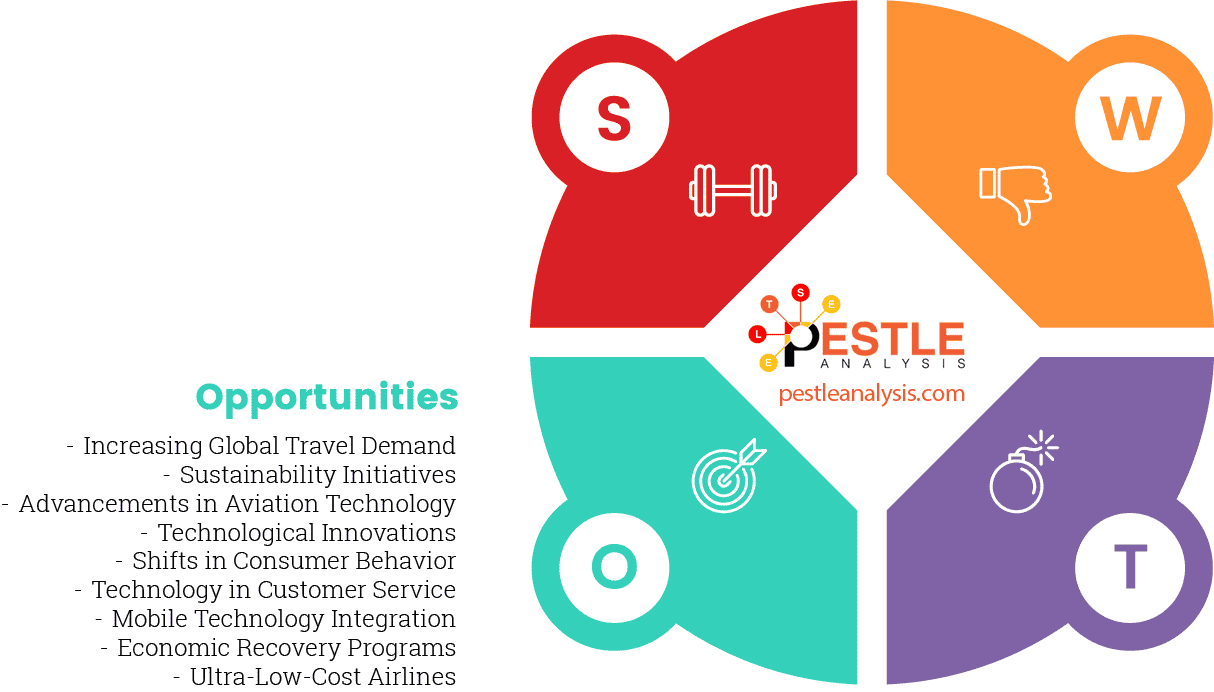

Southwest Airlines Opportunities

Some of the major opportunities for Southwest Airlines are expanding its routes and upgrading its fleets. In addition to this, Southwest can also re-think its cost structure so that they offer more amenities and compete with ultra-low-cost airlines.

Here’s an overview of Southwest’s opportunities:

- Increasing Global Travel Demand: As global travel demand rebounds post-pandemic, there's an opportunity for Southwest to expand its international routes or increase frequencies on existing routes to capture more of this market.

- According to the International Air Transport Association (IATA), global air travel demand in February 2024 saw a substantial increase of 21.5% compared to the same month in 2023, demonstrating a strong start to the year across all markets except North America.

- Further analysis by Airports Council International (ACI) supports these findings, predicting that global passenger volume will reach 9.4 billion by 2024, surpassing pre-pandemic levels from 2019. This marks a significant recovery, with the global passenger volume in 2023 reaching 94.2% of the 2019 level, setting the stage for further growth

- Sustainability Initiatives: With the aviation industry increasingly focused on reducing its carbon footprint, developments in sustainable aviation fuels and more efficient aircraft present opportunities for Southwest to lead in environmental stewardship. As of 2024, advancements in sustainable aviation fuels (SAFs) provide a significant opportunity for airlines like Southwest to enhance their sustainability efforts and meet increasing environmental standards.

- IATA has outlined a progressive increase in mandatory SAF blending rates, which will require significant adoption across the industry. Starting in 2025 with a 2% minimum blend, the requirement will rise to 70% by 2050, reflecting a strong institutional commitment to reducing aviation's climate impact

- Advancements in Aviation Technology: Innovations such as more efficient aircraft engines, improvements in air traffic management, and developments in digital and automation technologies can help Southwest reduce operational costs and enhance customer experience.

- Technological Innovations: Investing in newer technologies for booking, boarding, and customer service could improve efficiency and customer satisfaction.

- Shifts in Consumer Behavior: The rise of remote work has changed when and how people travel, creating opportunities for airlines to offer new types of services, such as mid-week flights or packages tailored to "digital nomads."

- The digital nomad community has been expanding rapidly, with estimates in 2023 showing that there are about 35 million digital nomads globally, with a significant portion, approximately 47%, coming from the United States. Digital nomads tend to prefer locations that are not only inspirational but also cost-effective, which could influence the development of targeted travel packages or routes by airlines to popular nomad hubs. Moreover, the financial aspect of being a digital nomad is quite favorable, with a substantial number of them earning between $75,000 to over $100,000 annually, which may enhance their ability to travel frequently. This financial independence, combined with their flexible lifestyle, means that digital nomads are a unique customer segment that could potentially prefer the budget-friendly and flexible travel options that Southwest Airlines offers.

- Technology in Customer Service: AI and machine learning developments offer airlines like Southwest new ways to enhance customer service, from personalized booking experiences to automated updates and handling customer inquiries.

- Mobile Technology Integration: Developing a more robust mobile app that offers everything from ticket booking to in-flight services could improve customer engagement.

- Economic Recovery Programs: Governmental economic stimulus measures aimed at boosting travel and tourism can create a more favorable environment for expanding airline operations.

- Ultra-Low-Cost Airlines: Ultra-low-cost airline routes are becoming increasingly popular. Ultra-low-cost carriers, or ULCC, unbundle the fare. In other words, the whole fare is broken into components that the passengers can choose to eliminate. Unbundling leaves anything over the base fare optional. Although Southwest offers low fares, it is a low-cost carrier and not an ultra-low-cost carrier. Therefore, Southwest can explore opportunities in the ULCC niche.

- Partnerships and Alliances: Emerging trends towards strategic partnerships within the industry, such as codeshare agreements or joint ventures, could allow Southwest to expand its network reach without significant capital expenditure.

- Health and Safety Innovations: In a world still aware of pandemic risks, innovations in health and safety, like touchless technologies and improved air filtration systems, can be a market differentiator for airlines prioritizing passenger well-being.

The biggest opportunity for Southwest is the dip in competition the pandemic has created. COVID-19 essentially put the airline industry on time-out. Southwest can use this time to re-imagine its role and re-create itself to face the heavy competition that is on its way.

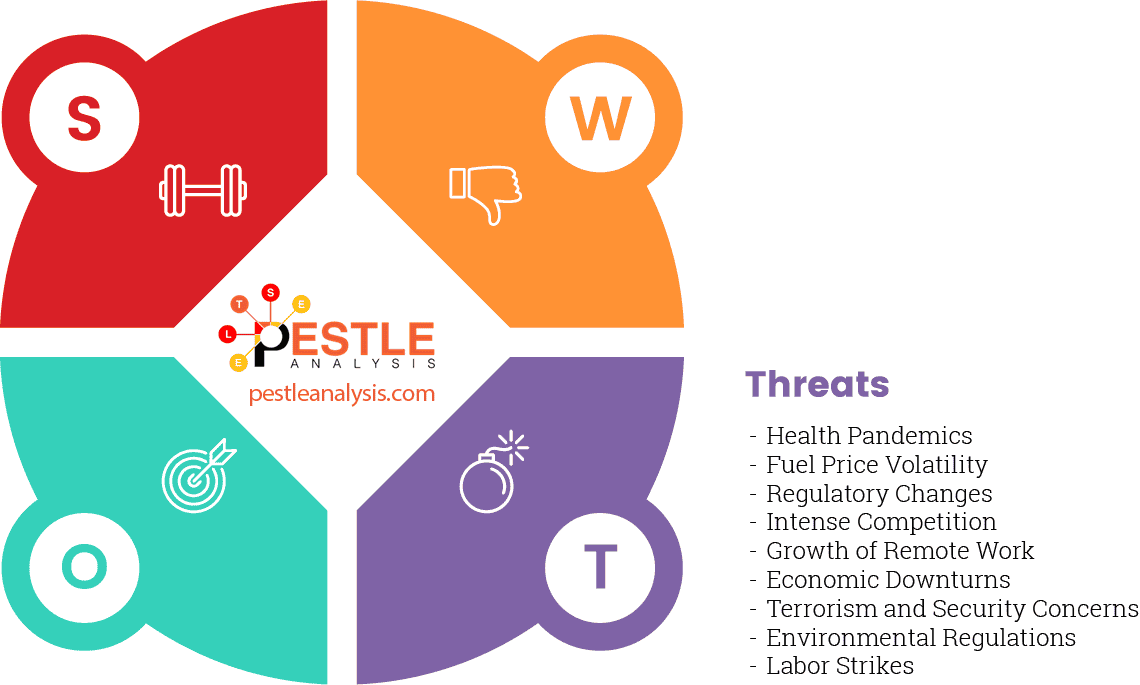

Southwest Airlines Threats

Traditionally, the biggest threats to Southwest airlines are fluctuating fuel prices, heavy regulation, and intense competition. In addition to these threats, Southwest airlines are also facing new threats such as COVID-19 restrictions and growth of remote work.

Let’s look at Southwest’s threats in more detail:

- Health Pandemics: Outbreaks like COVID-19 can drastically reduce travel demand and disrupt operations. After nearly 50 years of profitable operation, the pandemic led Southwest to its first loss. Southwest’s operating revenue fell from $22.4 billion in 2019 to $9 billion in 2020. As a result of this 59% drop, the company had to take aggressive measures to stay relevant.

- Fuel Price Volatility: Fluctuations in oil prices can significantly impact operating costs. In 2020, Southwest spent $1.8 billion on fuel. This expense is 14% of the total operating costs. So, fluctuations in fuel prices have a big impact on Southwest’s operating costs and profit.

- Regulatory Changes: New aviation regulations could introduce costly compliance requirements. The airline industry must satisfy the requirements of many operational and economic regulatory bodies such as the FAA and DOT. In addition to this, the company must also comply with many operational, health, and safety regulations. With the emergence of online commerce, the company must also address informational technology and data privacy regulations.

- Intense Competition: The pool of fliers shrank because of the global health crisis. As a result, the competition to acquire patronage has increased. In 2020, American Airlines, Southwest Airlines, Delta Airlines, and United Airlines accounted for nearly 66% of the market share in the United States. However, the individual market share of these companies was close.

- Growth of Remote Work: Lockdowns and social-distancing norms has accelerated work-from-home culture. Online video conferencing platforms such as Zoom has reduced the need for travel. The increase in online collaborative tools has also reduced the need for people to work under one roof. As a result, the segment of income from business travel has been severely hit. Airline companies fear that this behavior shift would be permanent.

- Economic Downturns: Recessions or economic slowdowns can lead to reduced consumer spending on travel.

- Terrorism and Security Concerns: Acts of terrorism could lead to tighter security measures and reduced demand for air travel.

- Environmental Regulations: Stricter emissions regulations could increase operational costs.

- Labor Strikes: Disputes with unions could lead to strikes, disrupting flight operations.

- Data Breaches: Cybersecurity threats that compromise customer data could lead to financial loss and damage to reputation.

- Climate Change Impacts: Extreme weather conditions could disrupt travel schedules and damage infrastructure.

- Currency Fluctuations: Can affect international revenue and costs.

- Political Instability: In regions where the airline operates, political unrest could affect travel patterns.

- Accidents or Safety Incidents: Can lead to a loss of consumer confidence and potential legal liabilities.

In today’s scenario, Southwest's biggest threats are the competition to acquire patrons and the decline in business travel. The silver lining for Southwest in this scenario is that it has been able to raise cash rapidly. It has also survived the pandemic without canceling any of its destinations.

Recommendations based on today's Southwest Airlines SWOT Table

The SWOT table summarizes SWOT analysis for Southwest airlines in an easy-to-read grid. Here are my recommendations for Southwest Airlines based on today's SWOT table.

- Expansion into International Markets: Targeting new international destinations could diversify revenue streams and reduce dependency on the U.S. domestic market. The pandemic has disturbed the existing order of flight routes. In the emerging new order, Southwest can find many gaps for under-serviced routes and expand its network.

- Upgrade Fleet: The airline industry (check out its PEST analysis here) is not the only victim of the economic recession. Aircraft manufacturers such as Boeing and Airbus have been hit hard as well. These companies are looking to increase their liquidity. Given Southwest’s financial position, now is the best time for Southwest to acquire new aircrafts for relatively low costs.

- Re-Think Cost Structure: At this time, the airline industry as a whole is recovering from a severe setback. Since Southwest got back on its feet more quickly than other airlines did, this recovery window is the perfect time for the company to make bold moves such as re-thinking its cost structure to compete with emerging ultra-low-cost airline companies.

- Revamping In-flight Experience: Upgrading in-flight amenities and entertainment options to enhance passenger satisfaction and compete with larger carriers. The tight competition and rigid operation locked Southwest into offering limited amenities for its passengers. In the years to come, the company anticipates the competition to increase. Before the race picks up and intensifies, Southwest can upgrade its fleet to offer more passenger amenities.

- Introduction of Premium Services: Developing a premium economy or business class service could attract business travelers and increase revenue per flight.

- Enhanced Cargo Operations: Expanding cargo services could capitalize on the growing demand for air freight, especially e-commerce shipments.

- Hub Expansion in Key Cities: Expanding presence in strategic cities could improve network efficiency and capture more passenger traffic.

If you want to learn how to make a SWOT table for another company or SWOT analysis in general, I have a lot of SWOT analysis examples for you to learn and increase your critical thinking skills. And for a step-by-step explanation, you can read everything you need to know about SWOT analys