Best Buy Co. (NYSE: BBY) is the largest operator of consumer electronics stores in the United States, with 1,779 locations and $39.49 billion in revenue as of July 31, 2015. Best Buy is also a major player in the world of ecommerce; BestBuy.com was the sixth largest ecommerce website in the United States, with 31 million users a month, according to Statista.[1]

Best Buy is one of the few consumer electronic chains to have survived and thrived in today’s highly competitive retail marketplace. It has managed to hold its own and make respectable profits despite aggressive competition from a wide variety of rivals.

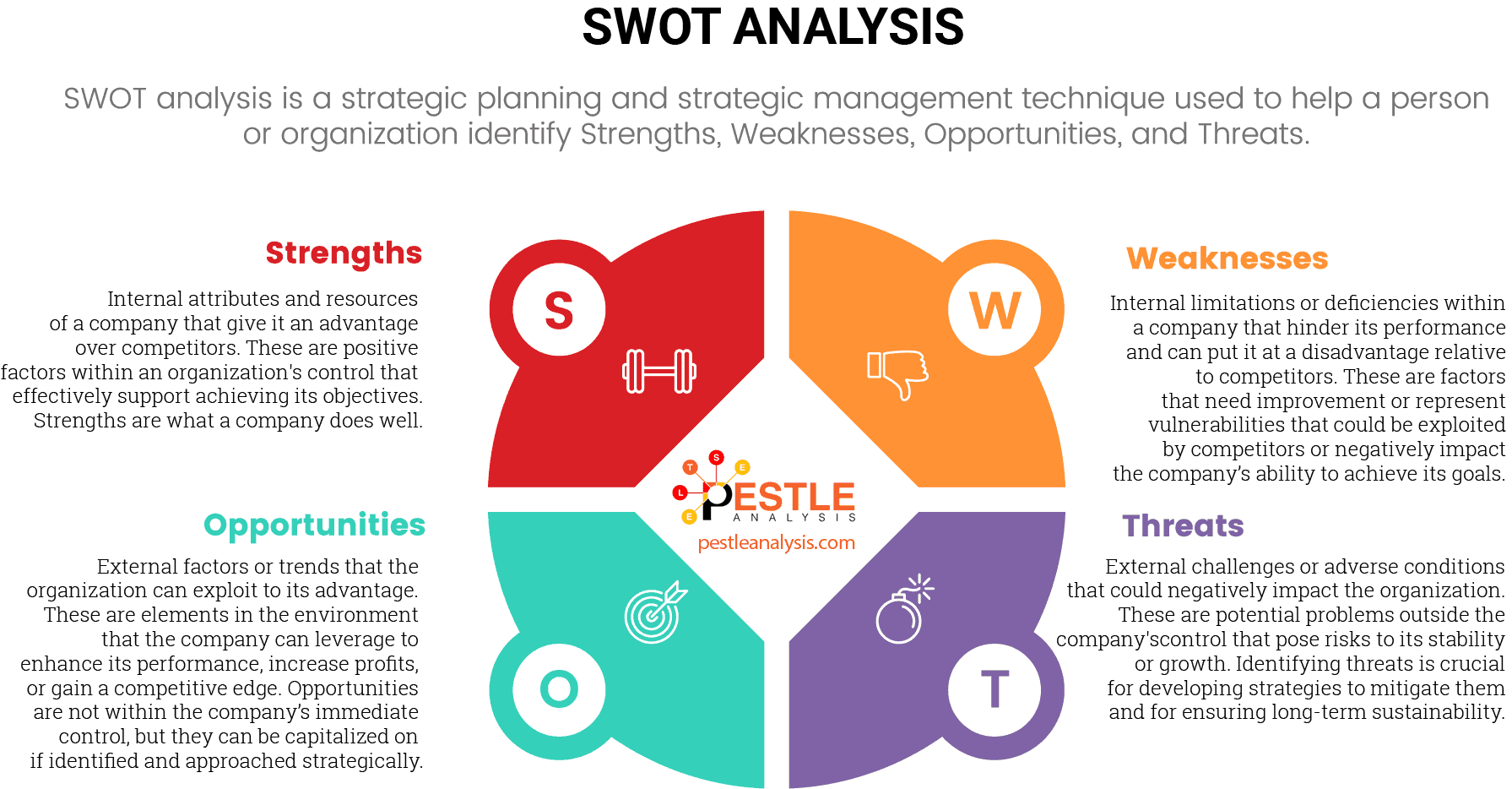

Although it has managed to survive even as some of its historic rivals such as Radio Shack and Circuit City have collapsed, Best Buy is in a potentially dangerous position in a radically changing market. A SWOT analysis (Strengths, Weaknesses, Opportunities and Threats) can show us if Best Buy is poised to survive or to fall by the wayside like some of its competitors.

Best Buy's Strengths

- Good reputation with customers, especially women, who make most of the consumer electronics purchases in the United States.

- A proven ability to retain customer loyalty.

- Strong marketing expertise in the electronics sector.

- Large footprint in the United States with 1,731 stores.

- Good relationship with popular brands such as Apple; in August 2015 Best Buy became the second store in the United States to sell the Apple Watch, after the Apple Store.[2]

- Successful track record in e-commerce. Internet Retailer estimated that Best Buy’s online sales were growing at a rate of 16.7% a year in March 2015. Best Buy generated around $3.54 billion from its online sales.[3]

- Growing market for consumer electronics products such as video games and smartphones.

- Large revenue flow of $39.49 billion on July 31, 2015.

Best Buy's Weaknesses

- Heavy dependence on brick-and-mortar locations at a time when e-commerce is growing at a rate of 15.4% annually.

- Limited profit margin of 1.92% on July 31, 2105.

- Limited amount of cash; Best Buy reported a free cash flow of $149 million on July 31, 2015.

- Highly dependent upon supplier credit. That means a large percentage of the items in Best Buy stores are not paid for. Instead, a manufacturer ships the goods to the stores and gets paid when the goods sell. If the stuff does not sell, Best Buy may have to pay for it after a specific period of time.

- Operating expenses in the stores are higher than those for online retailers. It is cheaper to house goods in a warehouse than operate a brick-and-mortar store. A store has such costs as rent, utilities, property taxes and employee salaries that have to be met each month.

- Dependent on sales of luxury items such as video games, demand of which can quickly fall off when the economy goes bad.

Best Buy's Opportunities

- There is a growing market for electronics, including mobile devices such as smartphones and video games.

- Release of new products by companies such as Apple, Samsung, Google and video game manufacturers generates media attention and free publicity for products on sale at Best Buy.

- The constant stream of new models of smartphones increases consumer interest and sales, particularly for Apple products such as the iPhone.

- The growing popularity of ecommerce allows Best Buy to increase sales volume without building new stores.

- The disappearance of competitors such as Radio Shack and Circuit City leaves Best Buy as the only major consumer electronics retailer in many markets.

- Increasing popularity of sales holidays such as Black Friday generates publicity and increases consumer interest in electronics.

- Improvements and enhancements to existing technologies such as the appearance of 3D TV creates new opportunities for electronics sales.

- The growing popularity of electronic media, especially video games and streaming videos, increases the demand for high-quality electronic devices.

Best Buy's Threats

- Digital delivery of electronic media, including movies and video games, reduces foot traffic.

- Online media delivery platforms such as Amazon.com, Apple iTunes, Google Play and Netflix are replacing brick-and-mortar stores as the primary source of entertainment products such as video games and movies.

- Aggressive discounting of electronics by online retailers. Companies such as Amazon.com, B&H, Newegg and eBay are increasingly undercutting Best Buy’s prices.

- Aggressive discounting of electronics by big box retailers such as Walmart, Costco and Target. Walmart sometimes uses television sets and video games as loss leaders to get customers into the store.

- A new generation of consumers seems to prefer online shopping for electronics online to visiting a brick-and-mortar store.

- The decline of shopping as a leisure activity.

- The widespread perception that electronics purchased online are always cheaper than those bought at a traditional store.

- Direct retail sales of electronics to consumers by manufacturers such as Apple and Samsung. Apple.com is now the fourth most popular retail website in the United States, attracting 77 million visitors a month.[4]

- Declining customer loyalty. Today’s customers are more likely to shop around and to visit a number of stores or websites before making a purchase.

- Walmart and Target are aggressively expanding their online retail operations and are more willing than ever to match or undercut Best Buy’s prices. Walmart wants to triple its online sales by building four new one-million-square-foot fulfillment centers. Each of those centers will contain up to 500,000 items.[5]

- Changes in technology could make some of the products that Best Buy depends upon for sales obsolete. For example, tablets and smartphones are replacing personal computers and laptops, and streaming video is making DVD players redundant. In the near future, advances could make other popular products such as video game systems obsolete, cutting into Best Buy’s sales.

Best Buy’s ability to adapt, survive and profit in a dramatically changing and highly competitive marketplace is impressive. Unfortunately, it is not clear if Best Buy will be able to avoid the fate of other popular electronics retailers that were unable to adapt to changes in the industry.

[1] http://www.statista.com/statistics/271450/monthly-unique-visitors-to-us-retail-websites/

[2] http://www.forbes.com/sites/greatspeculations/2015/10/19/best-buy-could-be-in-for-a-tough-holiday-season-as-competition-rises/

[3] https://www.internetretailer.com/2015/03/04/best-buys-web-sales-climb-almost-10-q4

[4] http://www.statista.com/statistics/271450/monthly-unique-visitors-to-us-retail-websites/

[5] http://www.wsj.com/articles/wal-mart-builds-supply-chain-to-meet-e-commerce-demands-1431016708

Image "Best Buy" by Mike Mozart is licensed under CC BY 2.0