The UK sugar tax, also known as the UK soft drinks industry levy, is a significant public health intervention that aims to reduce sugar consumption and tackle obesity.

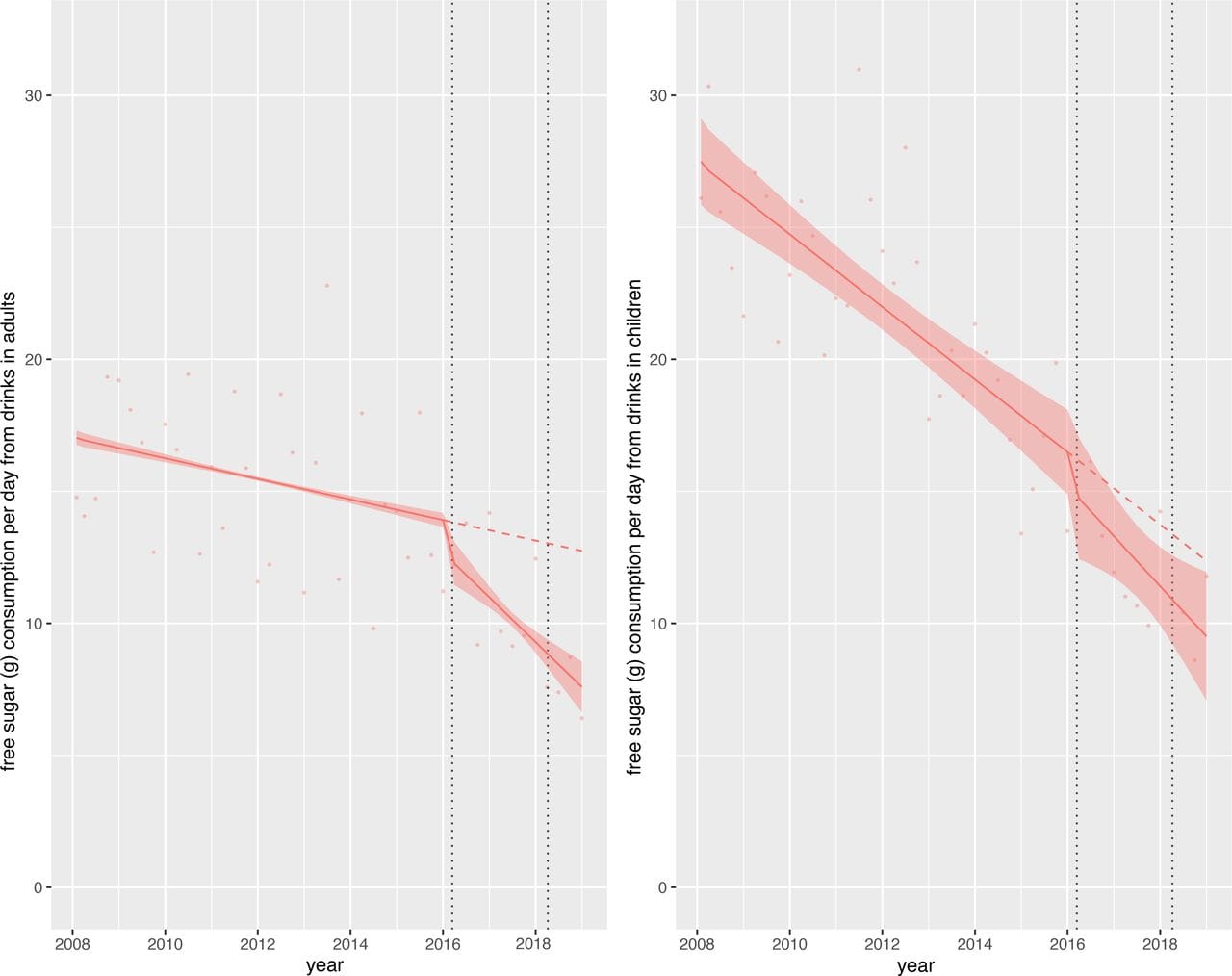

Recent studies have shown that the sugar tax has effectively reduced sugar consumption among both children and adults.

However, ongoing efforts are necessary to sustain and enhance these benefits. Future strategies may include broader taxation on other high-sugar products, comprehensive public health campaigns, and continuous monitoring and evaluation of the tax's impact on public health and the economy.

In the context of a PESTLE analysis, the sugar tax primarily falls under the Political and Economic factors.

Political Factor

The sugar tax was introduced as part of the UK government's anti-obesity strategy.

It reflects political will and public health policy aimed at improving population health. The government, by implementing this tax, demonstrated a commitment to combating obesity and related health issues.

The policy decision involved political considerations, including public health advocacy, budget allocations for health initiatives, and responding to public demand for healthier options.

The UK sugar tax is a clear example of how political factors can significantly impact companies. It reflects the political commitment to public health. This tax required legislative action, setting legal frameworks that companies had to adapt to, or face financial penalties.

This political action also sets a precedent for future regulations in the food and beverage industry, signaling ongoing government intervention to promote public health.

Economic Factor

The economic impact of the sugar tax is substantial for both the government and businesses.

The tax imposes a financial cost on soft drink manufacturers, incentivizing them to reformulate their products to contain less sugar to avoid the tax. This economic pressure has led to significant changes in the market. Companies that failed to reformulate their products saw price increases, potentially affecting sales and profitability.

Additionally, the revenue generated from the tax is allocated to fund health programs, such as primary school sports, creating economic benefits for public health initiatives.

Impact on Companies

The introduction of the sugar tax has had a notable impact on companies within the soft drinks industry, like Coca Cola, PepsiCo and RedBull: